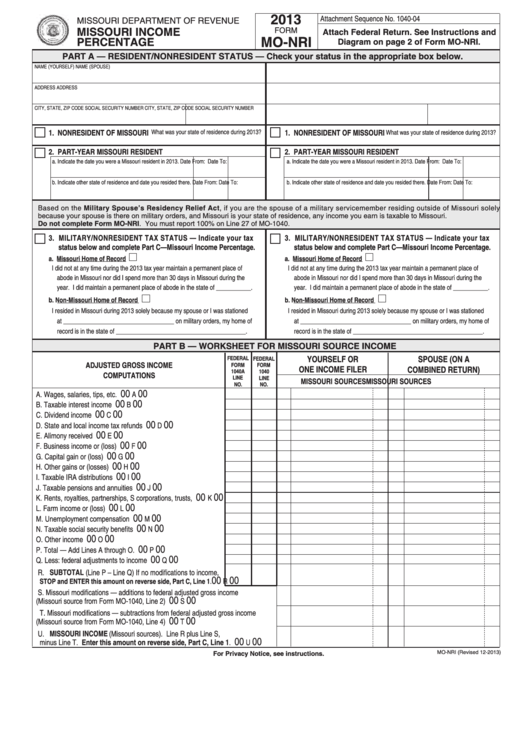

2013

Attachment Sequence No. 1040‑04

MISSOURI DEPARTMENT OF REVENUE

MISSOURI INCOME

FORM

Attach Federal Return. See Instructions and

MO-NRI

PERCENTAGE

Diagram on page 2 of Form MO-NRI.

PART A — RESIDENT/NONRESIDENT STATUS — Check your status in the appropriate box below.

NAME (YOURSELF)

NAME (SPOUSE)

ADDRESS

ADDRESS

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

1. NONRESIDENT OF MISSOURI

1. NONRESIDENT OF MISSOURI

What was your state of residence during 2013?

What was your state of residence during 2013?

2. PART-YEAR MISSOURI RESIDENT

2. PART-YEAR MISSOURI RESIDENT

a. Indicate the date you were a Missouri resident in 2013.

Date From:

Date To:

a. Indicate the date you were a Missouri resident in 2013.

Date From:

Date To:

b. Indicate other state of residence and date you resided there. Date From:

Date To:

b. Indicate other state of residence and date you resided there.

Date From:

Date To:

Based on the Military Spouse’s Residency Relief Act, if you are the spouse of a military servicemember residing outside of Missouri solely

because your spouse is there on military orders, and Missouri is your state of residence, any income you earn is taxable to Missouri.

Do not complete Form MO-NRI. You must report 100% on Line 27 of MO-1040.

3. MILITARY/NONRESIDENT TAX STATUS — Indicate your tax

3. MILITARY/NONRESIDENT TAX STATUS — Indicate your tax

status below and complete Part C—Missouri Income Percentage.

status below and complete Part C—Missouri Income Percentage.

a. Missouri Home of Record

a. Missouri Home of Record

I did not at any time during the 2013 tax year maintain a permanent place of

I did not at any time during the 2013 tax year maintain a permanent place of

abode in Missouri nor did I spend more than 30 days in Missouri during the

abode in Missouri nor did I spend more than 30 days in Missouri during the

year. I did maintain a permanent place of abode in the state of ___________.

year. I did maintain a permanent place of abode in the state of ___________.

b. Non-Missouri Home of Record

b. Non-Missouri Home of Record

I resided in Missouri during 2013 solely because my spouse or I was stationed

I resided in Missouri during 2013 solely because my spouse or I was stationed

at ___________________________________ on military orders, my home of

at ___________________________________ on military orders, my home of

record is in the state of _________________________________________.

record is in the state of _________________________________________.

PART B — WORKSHEET FOR MISSOURI SOURCE INCOME

YOURSELF OR

SPOUSE (ON A

FEDERAL

FEDERAL

ADJUSTED GROSS INCOME

FORM

FORM

ONE INCOME FILER

COMBINED RETURN)

1040A

1040

COMPUTATIONS

LINE

LINE

MISSOURI SOURCES

MISSOURI SOURCES

NO.

NO.

00

00

A. Wages, salaries, tips, etc. ........................................................

7

7

A

A

00

00

B. Taxable interest income ...........................................................

8a

8a

B

B

00

00

C. Dividend income ......................................................................

9a

9a

C

C

00

00

D. State and local income tax refunds ..........................................

none

10

D

D

00

00

E. Alimony received .....................................................................

none

11

E

E

00

00

F. Business income or (loss) ........................................................

none

12

F

F

00

00

G. Capital gain or (loss) ................................................................

10

13

G

G

00

00

H. Other gains or (losses) ............................................................

none

14

H

H

00

00

I. Taxable IRA distributions .........................................................

11b

15b

I

I

00

00

J. Taxable pensions and annuities ..............................................

12b

16b

J

J

00

00

K. Rents, royalties, partnerships, S corporations, trusts, etc........

none

17

K

K

00

00

L. Farm income or (loss) ..............................................................

none

18

L

L

00

00

M. Unemployment compensation .................................................

13

19

M

M

00

00

N. Taxable social security benefits ...............................................

14b

20b

N

N

00

00

O. Other income ...........................................................................

none

21

O

O

00

00

P. Total — Add Lines A through O. ..............................................

15

22

P

P

00

00

Q. Less: federal adjustments to income .......................................

20

36

Q

Q

R. SUBTOTAL (Line P – Line Q) If no modifications to income,

00

00

....

21

37

R

R

STOP and ENTER this amount on reverse side, Part C, Line 1.

S. Missouri modifications — additions to federal adjusted gross income

00

00

(Missouri source from Form MO‑1040, Line 2) ....................................................

S

S

T. Missouri modifications — subtractions from federal adjusted gross income

00

00

(Missouri source from Form MO‑1040, Line 4) ....................................................

T

T

U. MISSOURI INCOME (Missouri sources). Line R plus Line S,

00

00

minus Line T. Enter this amount on reverse side, Part C, Line 1. .................

U

U

MO-NRI (Revised 12-2013)

For Privacy Notice, see instructions.

1

1 2

2