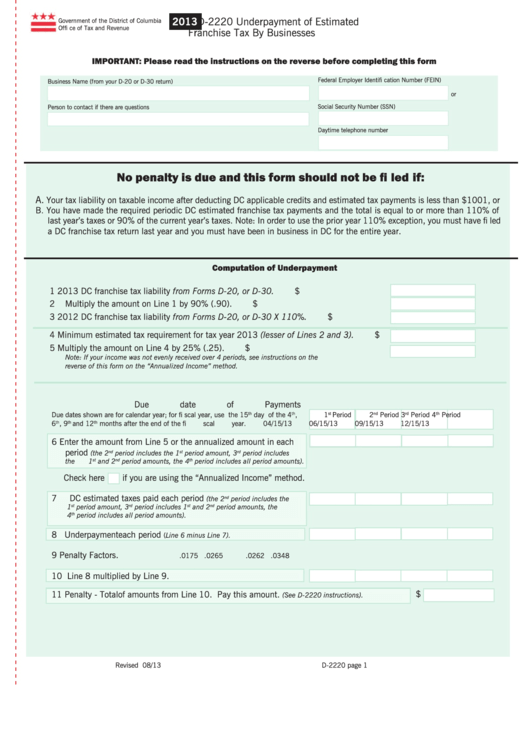

2013

D-2220 Underpayment of Estimated

Government of the District of Columbia

Offi ce of Tax and Revenue

Franchise Tax By Businesses

IMPORTANT: Please read the instructions on the reverse before completing this form

Federal Employer Identifi cation Number (FEIN)

Business Name (from your D-20 or D-30 return)

or

Person to contact if there are questions

Social Security Number (SSN)

Daytime telephone number

No penalty is due and this form should not be fi led if:

A.

Your tax liability on taxable income after deducting DC applicable credits and estimated tax payments is less than $1001, or

B. You have made the required periodic DC estimated franchise tax payments and the total is equal to or more than 110% of

last year’s taxes or 90% of the current year’s taxes. Note: In order to use the prior year 110% exception, you must have fi led

a DC franchise tax return last year and you must have been in business in DC for the entire year.

Computation of Underpayment

1

2013 DC franchise tax liability from Forms D-20, or D-30.

$

2

Multiply the amount on Line 1 by 90% (.90).

$

3

2012 DC franchise tax liability from Forms D-20, or D-30 X 110%.

$

4

Minimum estimated tax requirement for tax year 2013 (lesser of Lines 2 and 3).

$

5

Multiply the amount on Line 4 by 25% (.25).

$

Note: If your income was not evenly received over 4 periods, see instructions on the

reverse of this form on the “Annualized Income” method.

Due date of Payments

Due dates shown are for calendar year; for fi scal year, use the 15

th

day of the 4

th

,

1

st

Period

2

nd

Period

3

rd

Period

4

th

Period

6

th

, 9

th

and 12

th

months after the end of the fi scal year.

04/15/13

06/15/13

09/15/13

12/15/13

6 Enter the amount from Line 5 or the annualized amount in each

period

(the 2

nd

period includes the 1

st

period amount, 3

rd

period includes

the 1

st

and 2

nd

period amounts, the 4

th

period includes all period amounts).

Check here

if you are using the “Annualized Income” method.

7

DC estimated taxes paid each period

(the 2

nd

period includes the

1

st

period amount, 3

rd

period includes 1

st

and 2

nd

period amounts, the

4

th

period includes all period amounts).

8 Underpayment each period

(Line 6 minus Line 7).

9 Penalty Factors.

.0175

.0265

.0262

.0348

10 Line 8 multiplied by Line 9.

$

11 Penalty - Total of amounts from Line 10. Pay this amount.

(See D-2220 instructions).

Revised 08/13

D-2220 page 1

1

1 2

2