Print

Clear

l

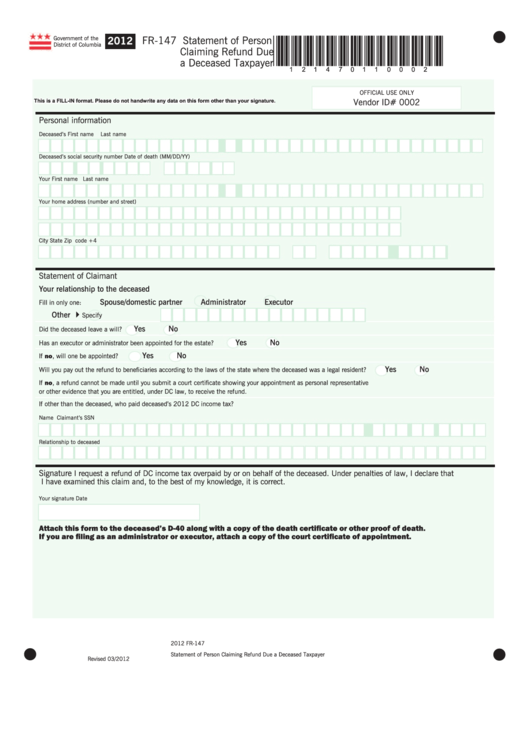

FR-147 Statement of Person

Government of the

2012

*121470110002*

District of Columbia

Claiming Refund Due

a Deceased Taxpayer

OFFICIAL USE ONLY

Vendor ID# 0002

This is a FILL-IN format. Please do not handwrite any data on this form other than your signature.

Personal information

Deceased’s First name

Last name

M.I.

Deceased’s social security number

Date of death (MM/DD/YY)

Your First name

Last name

M.I.

Your home address (number and street)

City

State

Zip code +4

Statement of Claimant

Your relationship to the deceased

Spouse/domestic partner

Administrator

Executor

Fill in only one:

Other

4

Specify

Yes

No

Did the deceased leave a will?

Yes

No

Has an executor or administrator been appointed for the estate?

Yes

No

If no, will one be appointed?

Yes

No

Will you pay out the refund to beneficiaries according to the laws of the state where the deceased was a legal resident?

If no, a refund cannot be made until you submit a court certificate showing your appointment as personal representative

or other evidence that you are entitled, under DC law, to receive the refund.

If other than the deceased, who paid deceased’s 2012 DC income tax?

Name

Claimant’s SSN

Relationship to deceased

Signature

I request a refund of DC income tax overpaid by or on behalf of the deceased. Under penalties of law, I declare that

I have examined this claim and, to the best of my knowledge, it is correct.

Your signature

Date

Attach this form to the deceased’s D-40 along with a copy of the death certificate or other proof of death.

If you are filing as an administrator or executor, attach a copy of the court certificate of appointment.

2012 FR-147

l

l

Statement of Person Claiming Refund Due a Deceased Taxpayer

Revised 03/2012

1

1