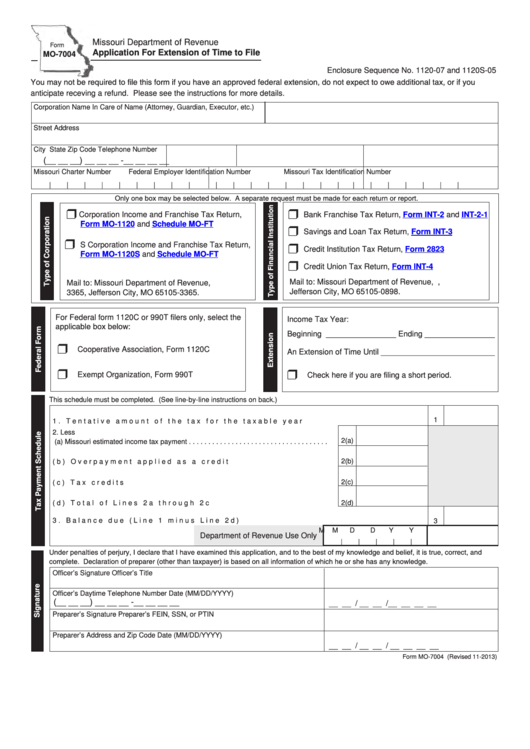

Missouri Department of Revenue

Form

Application For Extension of Time to File

MO-7004

Enclosure Sequence No. 1120-07 and 1120S-05

You may not be required to file this form if you have an approved federal extension, do not expect to owe additional tax, or if you

anticipate receving a refund. Please see the instructions for more details.

Corporation Name

In Care of Name (Attorney, Guardian, Executor, etc.)

Street Address

City

State

Zip Code

Telephone Number

(__ __ __) __ __ __ -__ __ __ __

Missouri Charter Number

Federal Employer Identification Number

Missouri Tax Identification Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only one box may be selected below. A separate request must be made for each return or report.

r

r

Corporation Income and Franchise Tax Return,

Bank Franchise Tax Return,

Form INT-2

and

INT-2-1

Form MO-1120

and

Schedule MO-FT

r

Savings and Loan Tax Return,

Form INT-3

r

S Corporation Income and Franchise Tax Return,

r

Credit Institution Tax Return,

Form 2823

Form MO-1120S

and

Schedule MO-FT

r

Credit Union Tax Return,

Form INT-4

Mail to: Missouri Department of Revenue, P.O. Box 898,

Mail to: Missouri Department of Revenue, P.O. Box

Jefferson City, MO 65105-0898.

3365, Jefferson City, MO 65105-3365.

For Federal form 1120C or 990T filers only, select the

Income Tax Year:

applicable box below:

Beginning ________________ Ending ________________

r

Cooperative Association, Form 1120C

An Extension of Time Until __________________________

r

r

Exempt Organization, Form 990T

Check here if you are filing a short period.

This schedule must be completed. (See line-by-line instructions on back.)

1

1. Tentative amount of the tax for the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Less

2(a)

(a) Missouri estimated income tax payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2(b)

(b) Overpayment applied as a credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2(c)

(c) Tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2(d)

(d) Total of Lines 2a through 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Balance due (Line 1 minus Line 2d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

M

M

D

D

Y

Y

Department of Revenue Use Only

|

|

|

|

|

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and

complete. Declaration of preparer (other than taxpayer) is based on all information of which he or she has any knowledge.

Officer’s Signature

Officer’s Title

Officer’s Daytime Telephone Number

Date (MM/DD/YYYY)

(__ __ __) __ __ __ -__ __ __ __

__ __ / __ __ /__ __ __ __

Preparer’s Signature

Preparer’s FEIN, SSN, or PTIN

Preparer’s Address and Zip Code

Date (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

Form MO-7004 (Revised 11-2013)

1

1 2

2