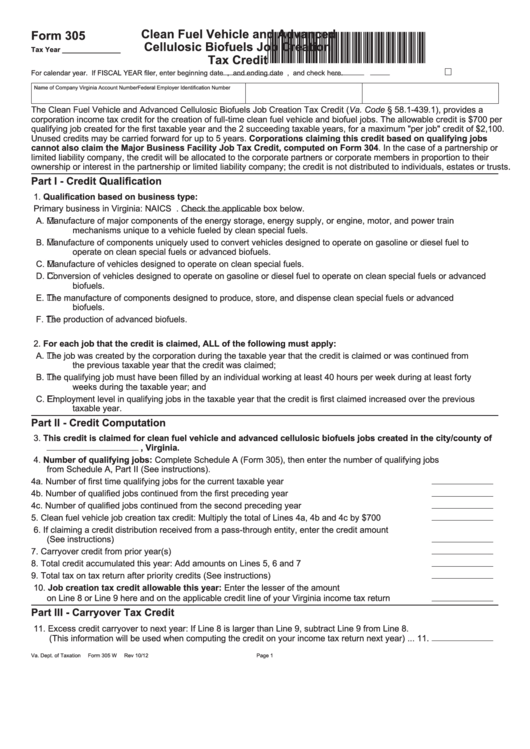

Clean Fuel Vehicle and Advanced

Form 305

*VA0305112888*

Cellulosic Biofuels Job Creation

Tax Year _______________

Tax Credit

For calendar year. If FISCAL YEAR filer, enter beginning date

,

and ending date

,

and check here.

Name of Company

Virginia Account Number

Federal Employer Identification Number

The Clean Fuel Vehicle and Advanced Cellulosic Biofuels Job Creation Tax Credit (Va. Code § 58.1-439.1), provides a

corporation income tax credit for the creation of full-time clean fuel vehicle and biofuel jobs. The allowable credit is $700 per

qualifying job created for the first taxable year and the 2 succeeding taxable years, for a maximum "per job" credit of $2,100.

Unused credits may be carried forward for up to 5 years. Corporations claiming this credit based on qualifying jobs

cannot also claim the Major Business Facility Job Tax Credit, computed on Form 304. In the case of a partnership or

limited liability company, the credit will be allocated to the corporate partners or corporate members in proportion to their

ownership or interest in the partnership or limited liability company; the credit is not distributed to individuals, estates or trusts.

Part I - Credit Qualification

1. Qualification based on business type:

Primary business in Virginia: NAICS

. Check the applicable box below.

A. Manufacture of major components of the energy storage, energy supply, or engine, motor, and power train

mechanisms unique to a vehicle fueled by clean special fuels.

B. Manufacture of components uniquely used to convert vehicles designed to operate on gasoline or diesel fuel to

operate on clean special fuels or advanced biofuels.

C. Manufacture of vehicles designed to operate on clean special fuels.

D. Conversion of vehicles designed to operate on gasoline or diesel fuel to operate on clean special fuels or advanced

biofuels.

E. The manufacture of components designed to produce, store, and dispense clean special fuels or advanced

biofuels.

F. The production of advanced biofuels.

2. For each job that the credit is claimed, ALL of the following must apply:

A. The job was created by the corporation during the taxable year that the credit is claimed or was continued from

the previous taxable year that the credit was claimed;

B. The qualifying job must have been filled by an individual working at least 40 hours per week during at least forty

weeks during the taxable year; and

C. Employment level in qualifying jobs in the taxable year that the credit is first claimed increased over the previous

taxable year.

Part II - Credit Computation

3. This credit is claimed for clean fuel vehicle and advanced cellulosic biofuels jobs created in the city/county of

, Virginia.

4. Number of qualifying jobs: Complete Schedule A (Form 305), then enter the number of qualifying jobs

from Schedule A, Part II (See instructions).

4a. Number of first time qualifying jobs for the current taxable year ...............................................4a.

4b. Number of qualified jobs continued from the first preceding year .............................................4b.

4c. Number of qualified jobs continued from the second preceding year ........................................4c.

5. Clean fuel vehicle job creation tax credit: Multiply the total of Lines 4a, 4b and 4c by $700 .............5.

6. If claiming a credit distribution received from a pass-through entity, enter the credit amount

(See instructions) ...............................................................................................................................6.

7. Carryover credit from prior year(s) .....................................................................................................7.

8. Total credit accumulated this year: Add amounts on Lines 5, 6 and 7 ...............................................8.

9. Total tax on tax return after priority credits (See instructions) ............................................................9.

10. Job creation tax credit allowable this year: Enter the lesser of the amount

on Line 8 or Line 9 here and on the applicable credit line of your Virginia income tax return .........10.

Part III - Carryover Tax Credit

11. Excess credit carryover to next year: If Line 8 is larger than Line 9, subtract Line 9 from Line 8.

(This information will be used when computing the credit on your income tax return next year) ... 11.

Va. Dept. of Taxation

Form 305 W

Rev 10/12

Page 1

1

1 2

2 3

3 4

4