Form Dtf-664 - Tax Shelter Disclosure For Material Advisors - 2015

ADVERTISEMENT

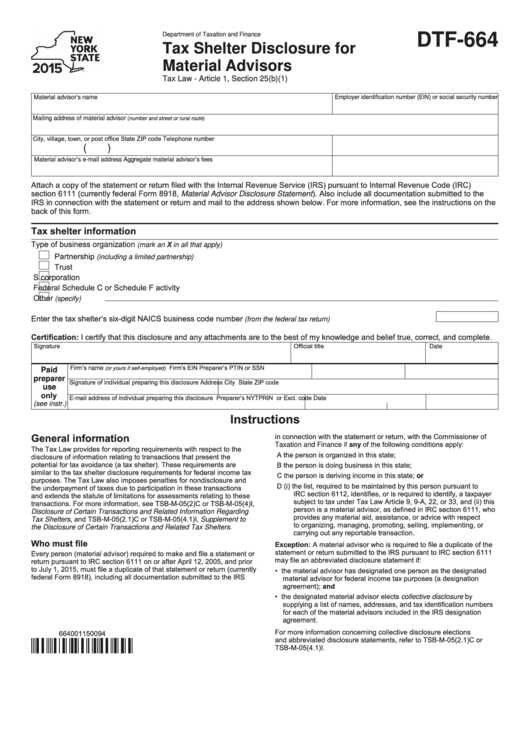

Department of Taxation and Finance

DTF-664

Tax Shelter Disclosure for

Material Advisors

Tax Law - Article 1, Section 25(b)(1)

Employer identification number (EIN) or social security number

Material advisor’s name

Mailing address of material advisor

(number and street or rural route)

City, village, town, or post office

State

ZIP code

Telephone number

(

)

Material advisor’s e-mail address

Aggregate material advisor’s fees

Attach a copy of the statement or return filed with the Internal Revenue Service (IRS) pursuant to Internal Revenue Code (IRC)

section 6111 (currently federal Form 8918, Material Advisor Disclosure Statement ). Also include all documentation submitted to the

IRS in connection with the statement or return and mail to the address shown below. For more information, see the instructions on the

back of this form.

Tax shelter information

Type of business organization

(mark an X in all that apply)

Partnership

(including a limited partnership)

Trust

S corporation

Federal Schedule C or Schedule F activity

Other

(specify)

Enter the tax shelter’s six-digit NAICS business code number

................................................

(from the federal tax return)

Certification: I certify that this disclosure and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature

Official title

Date

Firm’s EIN

Preparer’s PTIN or SSN

Firm’s name

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this disclosure

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this disclosure

Preparer’s NYTPRIN

or

Excl. code Date

(see instr.)

Instructions

General information

in connection with the statement or return, with the Commissioner of

Taxation and Finance if any of the following conditions apply:

The Tax Law provides for reporting requirements with respect to the

A the person is organized in this state;

disclosure of information relating to transactions that present the

potential for tax avoidance (a tax shelter). These requirements are

B the person is doing business in this state;

similar to the tax shelter disclosure requirements for federal income tax

C the person is deriving income in this state; or

purposes. The Tax Law also imposes penalties for nondisclosure and

D (i) the list, required to be maintained by this person pursuant to

the underpayment of taxes due to participation in these transactions

IRC section 6112, identifies, or is required to identify, a taxpayer

and extends the statute of limitations for assessments relating to these

subject to tax under Tax Law Article 9, 9-A, 22, or 33, and (ii) this

transactions. For more information, see TSB-M-05(2)C or TSB-M-05(4)I,

person is a material advisor, as defined in IRC section 6111, who

Disclosure of Certain Transactions and Related Information Regarding

provides any material aid, assistance, or advice with respect

Tax Shelters, and TSB-M-05(2.1)C or TSB-M-05(4.1)I, Supplement to

to organizing, managing, promoting, selling, implementing, or

the Disclosure of Certain Transactions and Related Tax Shelters.

carrying out any reportable transaction.

Who must file

Exception: A material advisor who is required to file a duplicate of the

statement or return submitted to the IRS pursuant to IRC section 6111

Every person (material advisor) required to make and file a statement or

may file an abbreviated disclosure statement if:

return pursuant to IRC section 6111 on or after April 12, 2005, and prior

to July 1, 2015, must file a duplicate of that statement or return (currently

• the material advisor has designated one person as the designated

federal Form 8918), including all documentation submitted to the IRS

material advisor for federal income tax purposes (a designation

agreement); and

• the designated material advisor elects collective disclosure by

supplying a list of names, addresses, and tax identification numbers

for each of the material advisors included in the IRS designation

agreement.

For more information concerning collective disclosure elections

664001150094

and abbreviated disclosure statements, refer to TSB-M-05(2.1)C or

TSB-M-05(4.1)I.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2