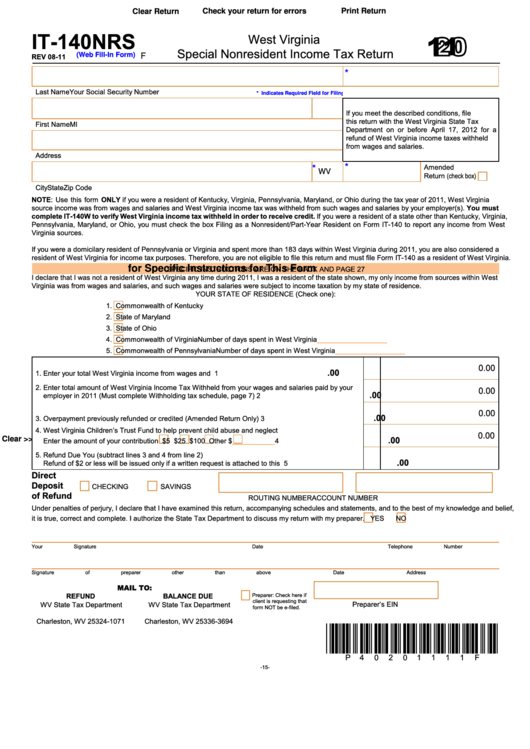

Check your return for errors

Print Return

Clear Return

IT-140NRS

2011

West Virginia

Special Nonresident Income Tax Return

F

REV 08-11

(Web Fill-In Form)

*

Last Name

Your Social Security Number

* Indicates Required Field for Filing

If you meet the described conditions, file

this return with the West Virginia State Tax

First Name

MI

Department on or before April 17, 2012 for a

refund of West Virginia income taxes withheld

from wages and salaries.

Address

Amended

*

*

WV

Return (check box)

City

State

Zip Code

NOTE: Use this form ONLY if you were a resident of Kentucky, Virginia, Pennsylvania, Maryland, or Ohio during the tax year of 2011, West Virginia

source income was from wages and salaries and West Virginia income tax was withheld from such wages and salaries by your employer(s). You must

complete IT-140W to verify West Virginia income tax withheld in order to receive credit. If you were a resident of a state other than Kentucky, Virginia,

Pennsylvania, Maryland, or Ohio, you must check the box Filing as a Nonresident/Part-Year Resident on Form IT-140 to report any income from West

Virginia sources.

If you were a domicilary resident of Pennsylvania or Virginia and spent more than 183 days within West Virginia during 2011, you are also considered a

resident of West Virginia for income tax purposes. Therefore, you are not eligible to file this return and must file Form IT-140 as a resident of West Virginia.

Click Here for Specific Instructions for This Form

SPECIFIC INSTRUCTIONS ARE ON THE BACK AND PAGE 27

I declare that I was not a resident of West Virginia any time during 2011, I was a resident of the state shown, my only income from sources within West

Virginia was from wages and salaries, and such wages and salaries were subject to income taxation by my state of residence.

YOUR STATE OF RESIDENCE (Check one):

1.

Commonwealth of Kentucky

2.

State of Maryland

3.

State of Ohio

4.

Commonwealth of Virginia

Number of days spent in West Virginia

__________________

5.

Commonwealth of Pennsylvania Number of days spent in West Virginia

__________________

0.00

.00

1. Enter your total West Virginia income from wages and salaries..................................................................

1

2. Enter total amount of West Virginia Income Tax Withheld from your wages and salaries paid by your

0.00

.00

employer in 2011 (Must complete Withholding tax schedule, page 7)........................................................

2

0.00

.00

3. Overpayment previously refunded or credited (Amended Return Only).....................................................

3

4. West Virginia Children’s Trust Fund to help prevent child abuse and neglect

0.00

.00

Clear >>

Enter the amount of your contribution

$5

$25

$100

Other $___________..........................

4

5. Refund Due You (subtract lines 3 and 4 from line 2)

.00

Refund of $2 or less will be issued only if a written request is attached to this form..................................

5

Direct

Deposit

CHECKING

SAVINGS

of Refund

ROUTING NUMBER

ACCOUNT NUMBER

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct and complete. I authorize the State Tax Department to discuss my return with my preparer.

YES

NO

Your Signature

Date

Telephone Number

Signature of preparer other than above

Date

Address

Daytime Phone Number

MAIL TO:

REFUND

BALANCE DUE

Preparer: Check here if

client is requesting that

Preparer’s EIN

WV State Tax Department

WV State Tax Department

form NOT be e-filed.

P.O. Box 1071

P.O. Box 3694

Charleston, WV 25324-1071

Charleston, WV 25336-3694

*p40201111F*

-15-

1

1 2

2 3

3 4

4