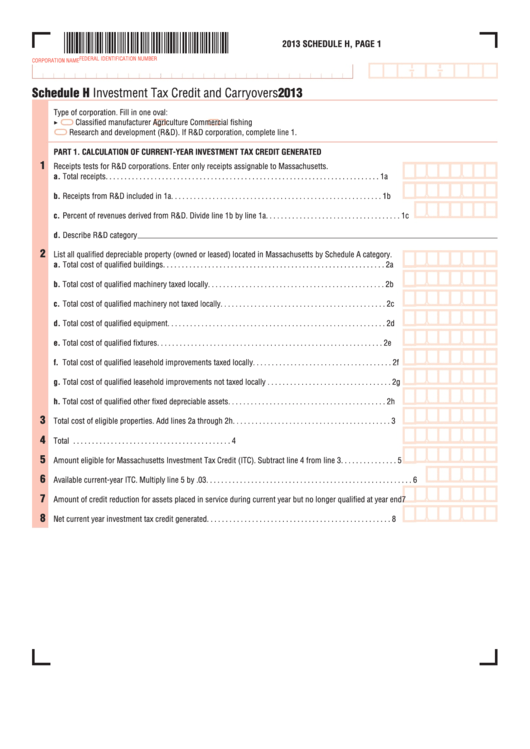

2013 SCHEDULE H, P GE 1

FEDERAL IDENTIFICATION NUMBER

CORPORATION NAME

Schedule

Investment Tax Credit and Carryovers

2013

Type of corporation. Fill in one oval:

Classified manufacturer

Agriculture

Commercial fishing

Research and development (R&D). If R&D corporation, complete line 1.

P RT 1. C LCUL TION OF CURRENT-YE R INVESTMENT T X CREDIT GENER TED

1

Receipts tests for R&D corporations. Enter only receipts assignable to Massachusetts.

a. Total receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

b. Receipts from R&D included in 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

c. Percent of revenues derived from R&D. Divide line 1b by line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

d. Describe R&D category

2

List all qualified depreciable property (owned or leased) located in Massachusetts by Schedule A category.

a. Total cost of qualified buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b. Total cost of qualified machinery taxed locally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c. Total cost of qualified machinery not taxed locally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

d. Total cost of qualified equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

e. Total cost of qualified fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

f. Total cost of qualified leasehold improvements taxed locally. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f

g. Total cost of qualified leasehold improvements not taxed locally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g

h. Total cost of qualified other fixed depreciable assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2h

3

Total cost of eligible properties. Add lines 2a through 2h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Total U.S. investment tax credit and U.S. basis reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Amount eligible for Massachusetts Investment Tax Credit (ITC). Subtract line 4 from line 3 . . . . . . . . . . . . . . . 5

6

Available current-year ITC. Multiply line 5 by .03. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Amount of credit reduction for assets placed in service during current year but no longer qualified at year end 7

8

Net current year investment tax credit generated. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

1

1 2

2 3

3