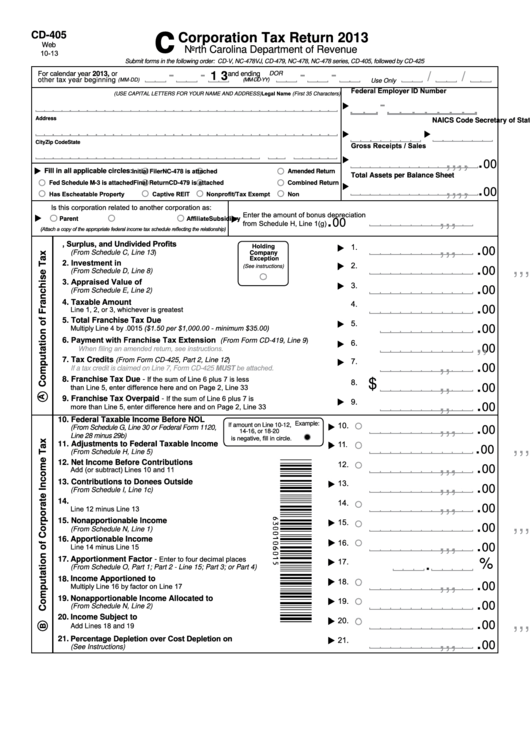

c

CD-405

Corporation Tax Return 2013

Web

North Carolina Department of Revenue

10-13

Submit forms in the following order: CD-V, NC-478VJ, CD-479, NC-478, NC-478 series, CD-405, followed by CD-425

For calendar year 2013, or

and ending

DOR

1 3

other tax year beginning

(MM-DD)

(MM-DD-YY)

Use Only

Federal Employer ID Number

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Address

Secretary of State ID

NAICS Code

City

State

Zip Code

Gross Receipts / Sales

.

,

,

,

,

00

Fill in all applicable circles:

Initial Filer

NC-478 is attached

Amended Return

Total Assets per Balance Sheet

.

Fed Schedule M-3 is attached

Final Return

CD-479 is attached

Combined Return

,

,

,

,

00

Has Escheatable Property

Captive REIT

Nonprofit/Tax Exempt

Non U.S./Foreign

Is this corporation related to another corporation as:

.

Enter the amount of bonus depreciation

,

,

,

Affiliate

Parent

Subsidiary

00

from Schedule H, Line 1(g)

(Attach a copy of the appropriate federal income tax schedule reflecting the relationship)

.

1. Capital Stock, Surplus, and Undivided Profits

,

,

,

Holding

1.

00

(From Schedule C, Line 13)

Company

.

Exception

2. Investment in N.C. Tangible Property

,

,

,

2.

(See instructions)

00

(From Schedule D, Line 8)

.

3. Appraised Value of N.C. Tangible Property

,

,

,

3.

00

(From Schedule E, Line 2)

.

,

,

,

4. Taxable Amount

4.

Line 1, 2, or 3, whichever is greatest

00

.

5. Total Franchise Tax Due

,

,

5.

Multiply Line 4 by .0015 ($1.50 per $1,000.00 - minimum $35.00)

00

.

6. Payment with Franchise Tax Extension

,

,

(From Form CD-419, Line 9)

6.

00

When filing an amended return, see instructions.

.

7. Tax Credits

7.

,

,

(From Form CD-425, Part 2, Line 12)

00

If a tax credit is claimed on Line 7, Form CD-425 MUST be attached.

.

If the sum of Line 6 plus 7 is less

8. Franchise Tax Due -

,

,

8.

$

00

than Line 5, enter difference here and on Page 2, Line 33

.

If the sum of Line 6 plus 7 is

9. Franchise Tax Overpaid -

,

,

9.

more than Line 5, enter difference here and on Page 2, Line 33

00

.

10. Federal Taxable Income Before NOL

,

,

,

10.

Example:

If amount on Line 10-12,

(From Schedule G, Line 30 or Federal Form 1120,

00

14-16, or 18-20

.

Line 28 minus 29b)

is negative, fill in circle.

,

,

,

11.

11. Adjustments to Federal Taxable Income

00

(From Schedule H, Line 5)

.

,

,

,

12. Net Income Before Contributions

12.

00

Add (or subtract) Lines 10 and 11

.

,

,

,

13.

13. Contributions to Donees Outside N.C.

00

(From Schedule I, Line 1c)

.

,

,

,

14.

14. N.C. Taxable Income

00

Line 12 minus Line 13

.

,

,

,

15.

15. Nonapportionable Income

00

(From Schedule N, Line 1)

.

16.

Apportionable Income

,

,

,

16.

00

Line 14 minus Line 15

.

Enter to four decimal places

17.

Apportionment Factor -

17.

%

(From Schedule O, Part 1; Part 2 - Line 15; Part 3; or Part 4)

.

,

,

,

18.

Income Apportioned to N.C.

18.

00

Multiply Line 16 by factor on Line 17

.

,

,

,

19.

Nonapportionable Income Allocated to N.C.

19.

00

(From Schedule N, Line 2)

.

20.

Income Subject to N.C. Tax

,

,

,

20.

00

Add Lines 18 and 19

.

Percentage Depletion over Cost Depletion on N.C. Property

,

,

,

21.

21.

00

(See Instructions)

1

1 2

2 3

3 4

4 5

5 6

6