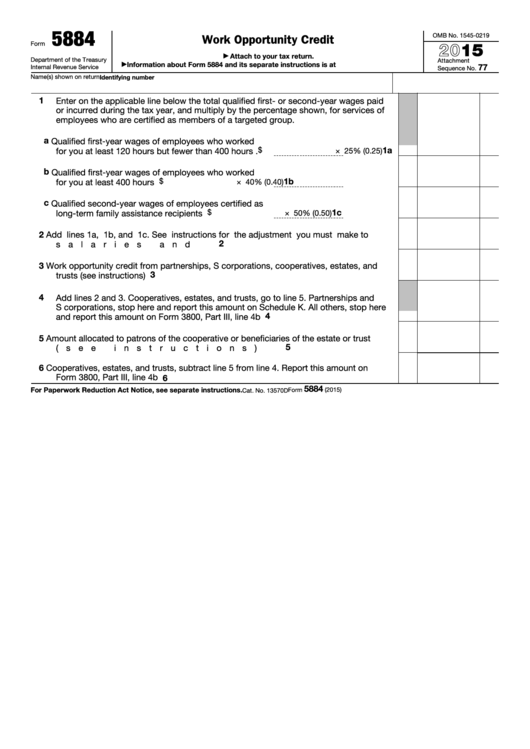

5884

OMB No. 1545-0219

Work Opportunity Credit

2015

Form

Attach to your tax return.

▶

Department of the Treasury

Attachment

Information about Form 5884 and its separate instructions is at

▶

77

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

1

Enter on the applicable line below the total qualified first- or second-year wages paid

or incurred during the tax year, and multiply by the percentage shown, for services of

employees who are certified as members of a targeted group.

a Qualified first-year wages of employees who worked

1a

$

for you at least 120 hours but fewer than 400 hours .

× 25% (0.25)

b Qualified first-year wages of employees who worked

1b

$

for you at least 400 hours

. . . . . . . . . .

× 40% (0.40)

c Qualified second-year wages of employees certified as

1c

$

long-term family assistance recipients . . . . . .

× 50% (0.50)

2

Add lines 1a, 1b, and 1c. See instructions for the adjustment you must make to

2

salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . .

3

Work opportunity credit from partnerships, S corporations, cooperatives, estates, and

3

trusts (see instructions)

. . . . . . . . . . . . . . . . . . . . . . .

4

Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and

S corporations, stop here and report this amount on Schedule K. All others, stop here

4

and report this amount on Form 3800, Part III, line 4b . . . . . . . . . . . .

5

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

5

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Cooperatives, estates, and trusts, subtract line 5 from line 4. Report this amount on

Form 3800, Part III, line 4b . . . . . . . . . . . . . . . . . . . . . .

6

5884

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2015)

Cat. No. 13570D

1

1