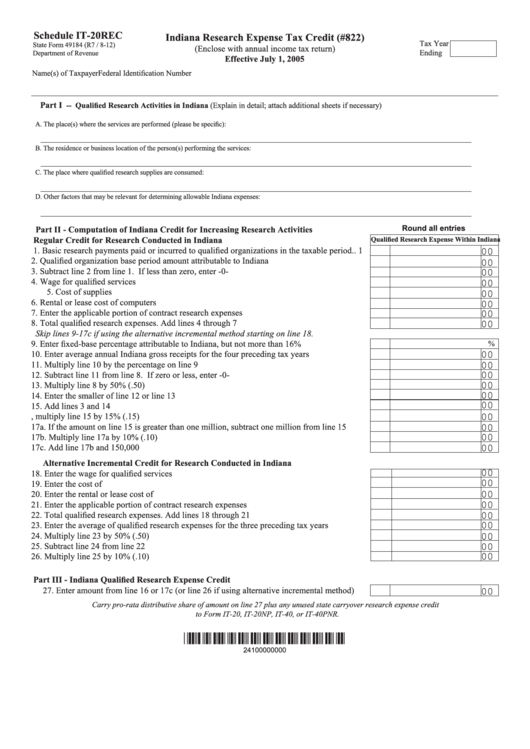

Schedule IT-20REC

Indiana Research Expense Tax Credit (#822)

Tax Year

State Form 49184 (R7 / 8-12)

(Enclose with annual income tax return)

Ending

Department of Revenue

Effective July 1, 2005

Name(s) of Taxpayer

Federal Identification Number

Part I

-- Qualified Research Activities in Indiana (Explain in detail; attach additional sheets if necessary)

A. The place(s) where the services are performed (please be specific):

B. The residence or business location of the person(s) performing the services:

C. The place where qualified research supplies are consumed:

D. Other factors that may be relevant for determining allowable Indiana expenses:

Round all entries

Part II - Computation of Indiana Credit for Increasing Research Activities

Regular Credit for Research Conducted in Indiana

Qualified Research Expense Within Indiana

1. Basic research payments paid or incurred to qualified organizations in the taxable period..

1

00

2. Qualified organization base period amount attributable to Indiana ......................................

2

00

3. Subtract line 2 from line 1. If less than zero, enter -0- .........................................................

3

00

00

4. Wage for qualified services ...................................................................................................

4

5. Cost of supplies .....................................................................................................................

5

00

6. Rental or lease cost of computers ..........................................................................................

6

00

00

7. Enter the applicable portion of contract research expenses ..................................................

7

8. Total qualified research expenses. Add lines 4 through 7 ....................................................

8

00

Skip lines 9-17c if using the alternative incremental method starting on line 18.

9. Enter fixed-base percentage attributable to Indiana, but not more than 16%........................

9

%

00

10. Enter average annual Indiana gross receipts for the four preceding tax years ...................... 10

00

11. Multiply line 10 by the percentage on line 9 ......................................................................... 11

00

12. Subtract line 11 from line 8. If zero or less, enter -0- .......................................................... 12

00

13. Multiply line 8 by 50% (.50) ................................................................................................. 13

00

14. Enter the smaller of line 12 or line 13 ................................................................................... 14

00

15. Add lines 3 and 14 ................................................................................................................. 15

00

16. If the amount on line 15 is one million or less, multiply line 15 by 15% (.15)..................... 16

00

17a. If the amount on line 15 is greater than one million, subtract one million from line 15 ....... 17a

00

17b. Multiply line 17a by 10% (.10) ............................................................................................. 17b

00

17c. Add line 17b and 150,000 ..................................................................................................... 17c

Alternative Incremental Credit for Research Conducted in Indiana

00

18. Enter the wage for qualified services .................................................................................... 18

00

19. Enter the cost of supplies....................................................................................................... 19

00

20. Enter the rental or lease cost of computers............................................................................ 20

00

21. Enter the applicable portion of contract research expenses .................................................. 21

00

22. Total qualified research expenses. Add lines 18 through 21 ................................................. 22

00

23. Enter the average of qualified research expenses for the three preceding tax years ............. 23

00

24. Multiply line 23 by 50% (.50) ............................................................................................... 24

00

25. Subtract line 24 from line 22 ................................................................................................. 25

00

26. Multiply line 25 by 10% (.10) ............................................................................................... 26

Part III - Indiana Qualified Research Expense Credit

27. Enter amount from line 16 or 17c (or line 26 if using alternative incremental method) ...... 27

00

Carry pro-rata distributive share of amount on line 27 plus any unused state carryover research expense credit

to Form IT-20, IT-20NP, IT-40, or IT-40PNR.

*24100000000*

24100000000

1

1 2

2