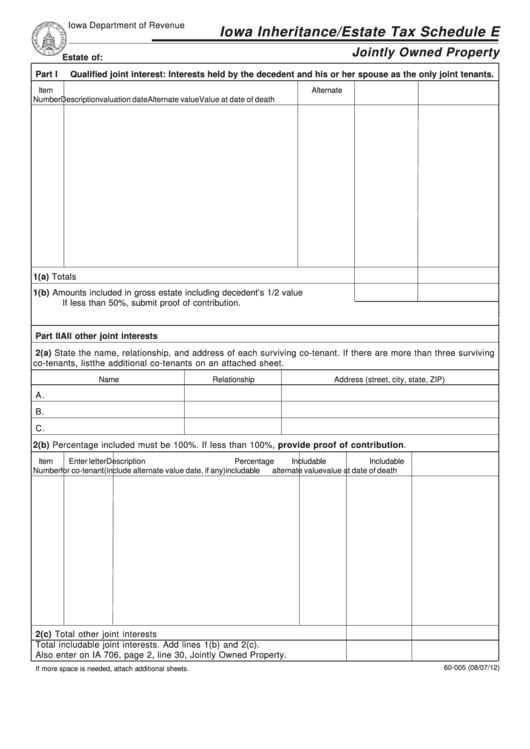

Form 60-005 - Iowa Inheritance/estate Tax Schedule E Jointly Owned Property

ADVERTISEMENT

Iowa Department of Revenue

Iowa Inheritance/Estate Tax Schedule E

Jointly Owned Property

Estate of:

Part I

Qualified joint interest: Interests held by the decedent and his or her spouse as the only joint tenants.

Item

Alternate

Number

Description

valuation date

Alternate value

Value at date of death

1(a) Totals ...............................................................................................................

1(b) Amounts included in gross estate including decedent’s 1/2 value

If less than 50%, submit proof of contribution.

Part II

All other joint interests

2(a) State the name, relationship, and address of each surviving co-tenant. If there are more than three surviving

co-tenants, list the additional co-tenants on an attached sheet.

Name

Relationship

Address (street, city, state, ZIP)

A .

B.

C.

2(b) Percentage included must be 100%. If less than 100%, provide proof of contribution.

Item

Enter letter

Description

Percentage

Includable

Includable

Number for co-tenant

(include alternate value date, if any)

includable

alternate value

value at date of death

2(c) Total other joint interests ...........................................................................

Total includable joint interests. Add lines 1(b) and 2(c).

Also enter on IA 706, page 2, line 30, Jointly Owned Property. .....................

60-005 (08/07/12)

If more space is needed, attach additional sheets.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1