4 (Rev. 04-13)

Form 4, Instructions for Application for Extension of Time to File Michigan Tax Returns

penalty and interest will accrue on the unpaid tax from the

Important Information

original due date of the return.

An extension of time to file is not an extension of time to pay.

• Payments made to date include withholding, estimated tax

Read the Line-by-Line Instructions before completing Form 4. The

payments, a credit forward from the previous tax year, and any

form and payment must be postmarked on or before the original due

other payments previously made for this tax year. Individual

date of the return.

income tax filers should include any Michigan withholding.

NOTE: Public Act 38 of 2011 established the Michigan

CIT and MBT

Corporate

Income

Tax

(CIT).

The

CIT

took

effect

Business tax filers must use this form to request an extension and

January 1, 2012, and replaced the Michigan Business Tax (MBT),

must file it even if the Internal Revenue Service has approved a

except for certain businesses that opt to continue claiming

federal extension.

certificated credits. Fiscal Filers of the CIT or MBT must consult

• If this form is properly prepared meeting all listed conditions

either the “Supplemental Instructions for Standard Fiscal CIT Filers”

and filed timely, Treasury will grant the taxpayer an extension

section in the CIT Forms and Instructions for Standard Taxpayers

(Form 4890) or the “Supplemental Instructions for Standard

to the last day of the eighth month beyond the original due date

regardless of whether you are granted a federal extension.

Fiscal MBT Filers” section in the MBT Forms and Instructions

for Standard Taxpayers (Form 4600), for additional details on

• Do not send a copy of the federal extension to Treasury. Retain

completing Form 4.

a copy for your records.

NOTE: Business tax filers should check the box for CIT or MBT

• An extension of time to file is not an extension of time to

based on the business tax they plan to file. However, this form will

pay. If there will be a business tax liability, payment must

extend both business taxes for the 2013 tax year if properly prepared

be included with this form and/or appropriate estimated

meeting all listed conditions and filed timely. This form does not

tax payments must have been made during the tax year,

make the election to remain under the MBT.

or the extension request will be denied. Late filing penalty and

interest will accrue on the unpaid tax from the original due date of

Income Tax (Individual and Fiduciary)

the return.

File Form 4 or a copy of your federal extension. An extension of

time to file the federal return automatically extends the time to file

Unitary Business Group (UBG)

the Michigan return to the new federal due date. An extension of

A UBG must file a combined return for its business taxes under

time to file is not an extension of time to pay. If you have not been

the name and Federal Employer Identification Number (FEIN)

granted a federal extension, the Michigan Department of Treasury

or Michigan Treasury (TR) assigned number of the Designated

(Treasury) will grant a 180-day extension for individual income tax

Member (DM) of the group. Only the DM may submit a valid

and composite returns, or a 150-day extension for fiduciary returns.

Form 4 for the UBG. If any other member submits Form 4, it will

• Do not file this form if a refund is expected or if you are not

not extend the time for filing the combined return. Any payment

submitting payment with this form.

included with such request will be applied to the UBG. If a UBG

includes standard members and financial institutions, it will have

• If, at the time the extension is filed, it is determined additional

two DMs and file two combined returns. In that case, a separate

Michigan tax is due, send the amount due and a completed

Form 4 or a copy of your federal extension form. If filing Form

extension must be requested (if desired) for each combined return,

through the DM designated on that return. For more information,

4, do not send a copy of the federal extension to Treasury.

Retain a copy for your records. Extension requests received

see the “Supplemental Instructions for Standard Members in

without payment on the account will not be honored and

UBGs” section in Form 4890 or Form 4600.

Reset Form

#

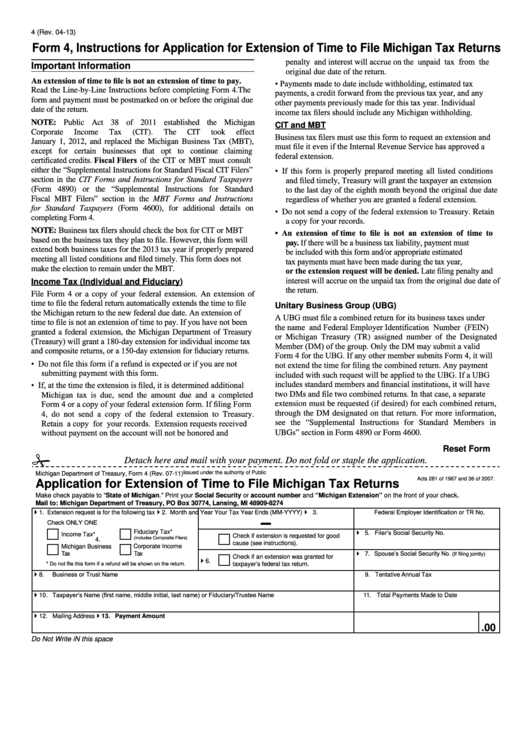

Detach here and mail with your payment. Do not fold or staple the application.

Issued under the authority of Public

Michigan Department of Treasury, Form 4 (Rev. 07-11)

Acts 281 of 1967 and 36 of 2007.

Application for Extension of Time to File Michigan Tax Returns

Make check payable to “State of Michigan.” Print your Social Security or account number and “Michigan Extension” on the front of your check.

Mail to: Michigan Department of Treasury, PO Box 30774, Lansing, MI 48909-8274

4

4

4

3. Federal Employer Identification or TR No.

1. Extension request is for the following tax

2. Month and Year Your Tax Year Ends (MM-YYYY)

Check oNly oNE

5. Filer’s Social Security No.

Fiduciary Tax*

4

Income Tax*

Check if extension is requested for good

(includes Composite Filers)

4.

cause (see instructions).

Corporate Income

Michigan Business

4

7. Spouse’s Social Security No.

(If filing jointly)

Tax

Tax

Check if an extension was granted for

4

6.

* Do not file this form if a refund will be shown on the return.

taxpayer’s federal tax return.

Business or Trust Name

4

8.

9. Tentative Annual Tax

4

10. Taxpayer’s Name (first name, middle initial, last name) or Fiduciary/Trustee Name

11. Total Payments Made to Date

4

4

12. Mailing Address

13. Payment Amount

.00

Do Not Write iN this space

1

1 2

2