Form 2 - Application For Amusement Device Permit

ADVERTISEMENT

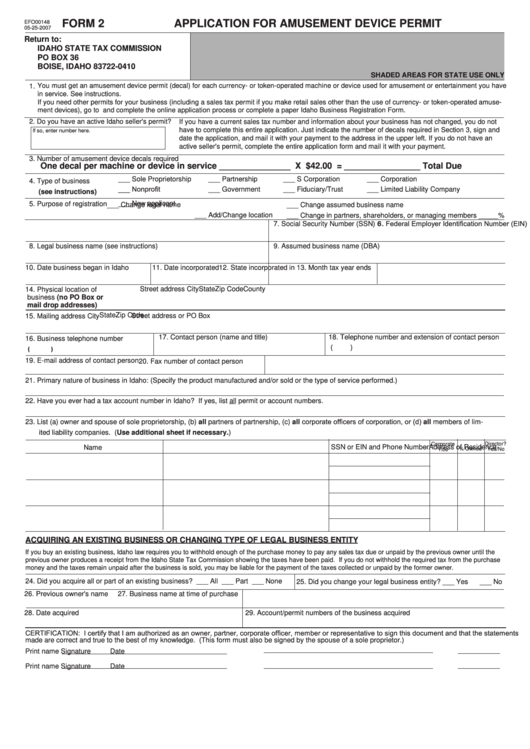

FORM 2

APPLICATION FOR AMUSEMENT DEVICE PERMIT

EFO00148

05-25-2007

Return to:

IDAHO STATE TAX COMMISSION

PO BOX 36

BOISE, IDAHO 83722-0410

SHADED AREAS FOR STATE USE ONLY

You must get an amusement device permit (decal) for each currency- or token-operated machine or device used for amusement or entertainment you have

1.

in service. See instructions.

If you need other permits for your business (including a sales tax permit if you make retail sales other than the use of currency- or token-operated amuse-

ment devices), go to and complete the online application process or complete a paper Idaho Business Registration Form.

2. Do you have an active Idaho seller's permit?

If you have a current sales tax number and information about your business has not changed, you do not

have to complete this entire application. Just indicate the number of decals required in Section 3, sign and

If so, enter number here.

date the application, and mail it with your payment to the address in the upper left. If you do not have an

active seller's permit, complete the entire application form and mail it with your payment.

3. Number of amusement device decals required

One decal per machine or device in service _______________ X $42.00 = ________________ Total Due

___ Sole Proprietorship

___ Partnership

___ S Corporation

___ Corporation

4. Type of business

___ Nonprofit

___ Government

___ Fiduciary/Trust

___ Limited Liability Company

(see instructions)

___ New applicant

5. Purpose of registration

___ Change legal name

___ Change assumed business name

___ Add/Change location

___ Change in partners, shareholders, or managing members _____%

6. Federal Employer Identification Number (EIN)

7. Social Security Number (SSN)

8. Legal business name (see instructions)

9. Assumed business name (DBA)

10. Date business began in Idaho

11. Date incorporated

12. State incorporated in

13. Month tax year ends

Street address

City

County

State

Zip Code

14. Physical location of

business (no PO Box or

mail drop addresses)

State

Zip Code

Street address or PO Box

15. Mailing address

City

17. Contact person (name and title)

18. Telephone number and extension of contact person

16. Business telephone number

(

)

(

)

19. E-mail address of contact person

20. Fax number of contact person

21. Primary nature of business in Idaho: (Specify the product manufactured and/or sold or the type of service performed.)

22. Have you ever had a tax account number in Idaho? If yes, list all permit or account numbers.

23. List (a) owner and spouse of sole proprietorship, (b) all partners of partnership, (c) all corporate officers of corporation, or (d) all members of lim-

ited liability companies. (Use additional sheet if necessary.)

Director?

Corporate

Address of Residence

SSN or EIN and Phone Number

Name

% Owned

Title

Yes/No

ACQUIRING AN EXISTING BUSINESS OR CHANGING TYPE OF LEGAL BUSINESS ENTITY

If you buy an existing business, Idaho law requires you to withhold enough of the purchase money to pay any sales tax due or unpaid by the previous owner until the

previous owner produces a receipt from the Idaho State Tax Commission showing the taxes have been paid. If you do not withhold the required tax from the purchase

money and the taxes remain unpaid after the business is sold, you may be liable for the payment of the taxes collected or unpaid by the former owner.

24. Did you acquire all or part of an existing business? ___ All ___ Part ___ None

25. Did you change your legal business entity? ___ Yes

___ No

26. Previous owner's name

27. Business name at time of purchase

28. Date acquired

29. Account/permit numbers of the business acquired

CERTIFICATION: I certify that I am authorized as an owner, partner, corporate officer, member or representative to sign this document and that the statements

made are correct and true to the best of my knowledge. (This form must also be signed by the spouse of a sole proprietor.)

Print name

Signature

Date

Print name

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2