Clear Form

Page 46

DO NOT FILE WITH YOUR RETURN - For Reference Only

2014 Worksheets

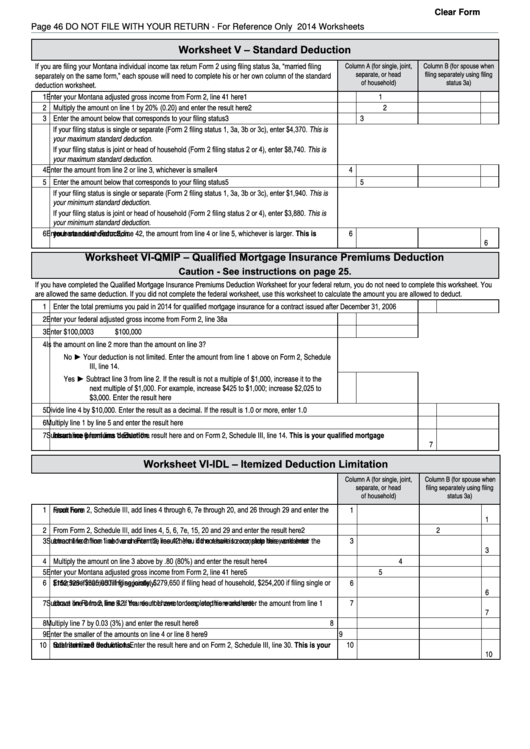

Worksheet V – Standard Deduction

If you are filing your Montana individual income tax return Form 2 using filing status 3a, “married filing

Column A (for single, joint,

Column B (for spouse when

separate, or head

filing separately using filing

separately on the same form,” each spouse will need to complete his or her own column of the standard

of household)

status 3a)

deduction worksheet.

1 Enter your Montana adjusted gross income from Form 2, line 41 here ..............................................

1

1

2 Multiply the amount on line 1 by 20% (0.20) and enter the result here ..............................................

2

2

3 Enter the amount below that corresponds to your filing status ............................................................

3

3

If your filing status is single or separate (Form 2 filing status 1, 3a, 3b or 3c), enter $4,370. This is

your maximum standard deduction.

If your filing status is joint or head of household (Form 2 filing status 2 or 4), enter $8,740. This is

your maximum standard deduction.

4 Enter the amount from line 2 or line 3, whichever is smaller ...............................................................

4

4

5 Enter the amount below that corresponds to your filing status ............................................................

5

5

If your filing status is single or separate (Form 2 filing status 1, 3a, 3b or 3c), enter $1,940. This is

your minimum standard deduction.

If your filing status is joint or head of household (Form 2 filing status 2 or 4), enter $3,880. This is

your minimum standard deduction.

6 Enter here and on Form 2, line 42, the amount from line 4 or line 5, whichever is larger. This is

your standard deduction. ................................................................................................................

6

6

Worksheet VI-QMIP – Qualified Mortgage Insurance Premiums Deduction

Caution - See instructions on page 25.

If you have completed the Qualified Mortgage Insurance Premiums Deduction Worksheet for your federal return, you do not need to complete this worksheet. You

are allowed the same deduction. If you did not complete the federal worksheet, use this worksheet to calculate the amount you are allowed to deduct.

1 Enter the total premiums you paid in 2014 for qualified mortgage insurance for a contract issued after December 31, 2006 .......

1

2 Enter your federal adjusted gross income from Form 2, line 38a .......................................................

2

3 Enter $100,000 ...................................................................................................................................

3

$100,000

4 Is the amount on line 2 more than the amount on line 3?

No ► Your deduction is not limited. Enter the amount from line 1 above on Form 2, Schedule

III, line 14.

Yes ► Subtract line 3 from line 2. If the result is not a multiple of $1,000, increase it to the

next multiple of $1,000. For example, increase $425 to $1,000; increase $2,025 to

$3,000. Enter the result here .........................................................................................

4

5 Divide line 4 by $10,000. Enter the result as a decimal. If the result is 1.0 or more, enter 1.0 ........................................................

5

6 Multiply line 1 by line 5 and enter the result here ............................................................................................................................

6

7 Subtract line 6 from line 1. Enter the result here and on Form 2, Schedule III, line 14. This is your qualified mortgage

insurance premiums deduction. ..................................................................................................................................................

7

Worksheet VI-IDL – Itemized Deduction Limitation

Column A (for single, joint,

Column B (for spouse when

separate, or head

filing separately using filing

of household)

status 3a)

1 From Form 2, Schedule III, add lines 4 through 6, 7e through 20, and 26 through 29 and enter the

result here ...........................................................................................................................................

1

1

2 From Form 2, Schedule III, add lines 4, 5, 6, 7e, 15, 20 and 29 and enter the result here ................

2

2

3 Subtract line 2 from line 1 and enter the result here. If the result is zero, stop here, and enter the

amount from line 1 above on Form 2, line 42. You do not have to complete this worksheet ..............

3

3

4 Multiply the amount on line 3 above by .80 (80%) and enter the result here .....................................

4

4

5 Enter your Montana adjusted gross income from Form 2, line 41 here ..............................................

5

5

6 Enter here $305,050 if filing jointly, $279,650 if filing head of household, $254,200 if filing single or

$152,525 if married filing separately ...................................................................................................

6

6

7 Subtract line 6 from line 5. If the result is zero or less, stop here and enter the amount from line 1

above on Form 2, line 42. You do not have to complete this worksheet ............................................

7

7

8 Multiply line 7 by 0.03 (3%) and enter the result here ........................................................................

8

8

9 Enter the smaller of the amounts on line 4 or line 8 here ...................................................................

9

9

10 Subtract line 9 from line 1. Enter the result here and on Form 2, Schedule III, line 30. This is your

total itemized deductions. ...............................................................................................................

10

10

1

1