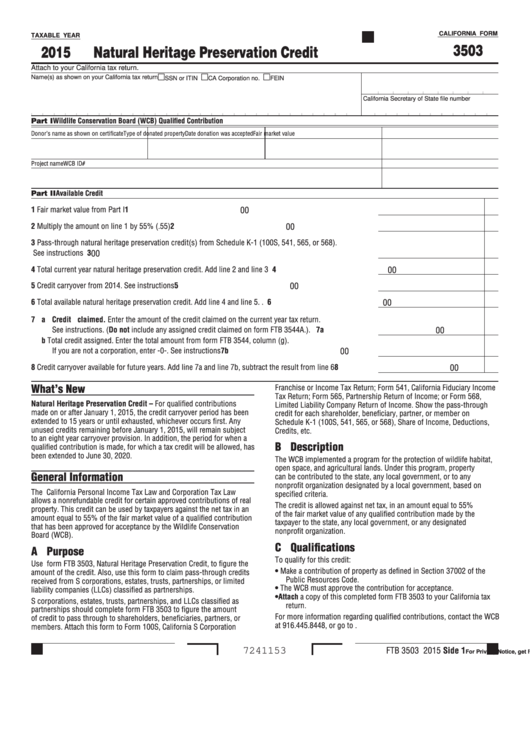

CALIFORNIA FORM

TAXABLE YEAR

3503

2015

Natural Heritage Preservation Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

Part I

Wildlife Conservation Board (WCB) Qualified Contribution

Donor’s name as shown on certificate

Type of donated property

Date donation was accepted

Fair market value

Project name

WCB ID#

Part II Available Credit

1 Fair market value from Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Multiply the amount on line 1 by 55% (.55) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Pass-through natural heritage preservation credit(s) from Schedule K-1 (100S, 541, 565, or 568).

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Total current year natural heritage preservation credit. Add line 2 and line 3. . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from 2014. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Total available natural heritage preservation credit. Add line 4 and line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 a Credit claimed. Enter the amount of the credit claimed on the current year tax return.

See instructions. (Do not include any assigned credit claimed on form FTB 3544A.). . . . . . . . . . . . . . . 7a

00

b Total credit assigned. Enter the total amount from form FTB 3544, column (g).

If you are not a corporation, enter -0-. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

00

8 Credit carryover available for future years. Add line 7a and line 7b, subtract the result from line 6. . . . . . . . 8

00

What’s New

Franchise or Income Tax Return; Form 541, California Fiduciary Income

Tax Return; Form 565, Partnership Return of Income; or Form 568,

Natural Heritage Preservation Credit – For qualified contributions

Limited Liability Company Return of Income. Show the pass-through

made on or after January 1, 2015, the credit carryover period has been

credit for each shareholder, beneficiary, partner, or member on

extended to 15 years or until exhausted, whichever occurs first. Any

Schedule K-1 (100S, 541, 565, or 568), Share of Income, Deductions,

unused credits remaining before January 1, 2015, will remain subject

Credits, etc.

to an eight year carryover provision. In addition, the period for when a

B Description

qualified contribution is made, for which a tax credit will be allowed, has

been extended to June 30, 2020.

The WCB implemented a program for the protection of wildlife habitat,

open space, and agricultural lands. Under this program, property

General Information

can be contributed to the state, any local government, or to any

nonprofit organization designated by a local government, based on

The California Personal Income Tax Law and Corporation Tax Law

specified criteria.

allows a nonrefundable credit for certain approved contributions of real

The credit is allowed against net tax, in an amount equal to 55%

property. This credit can be used by taxpayers against the net tax in an

of the fair market value of any qualified contribution made by the

amount equal to 55% of the fair market value of a qualified contribution

taxpayer to the state, any local government, or any designated

that has been approved for acceptance by the Wildlife Conservation

nonprofit organization.

Board (WCB).

C Qualifications

A Purpose

To qualify for this credit:

Use form FTB 3503, Natural Heritage Preservation Credit, to figure the

• Make a contribution of property as defined in Section 37002 of the

amount of the credit. Also, use this form to claim pass-through credits

Public Resources Code.

received from S corporations, estates, trusts, partnerships, or limited

• The WCB must approve the contribution for acceptance.

liability companies (LLCs) classified as partnerships.

• Attach a copy of this completed form FTB 3503 to your California tax

S corporations, estates, trusts, partnerships, and LLCs classified as

return.

partnerships should complete form FTB 3503 to figure the amount

For more information regarding qualified contributions, contact the WCB

of credit to pass through to shareholders, beneficiaries, partners, or

at 916.445.8448, or go to wcb.ca.gov.

members. Attach this form to Form 100S, California S Corporation

FTB 3503 2015 Side 1

7241153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2