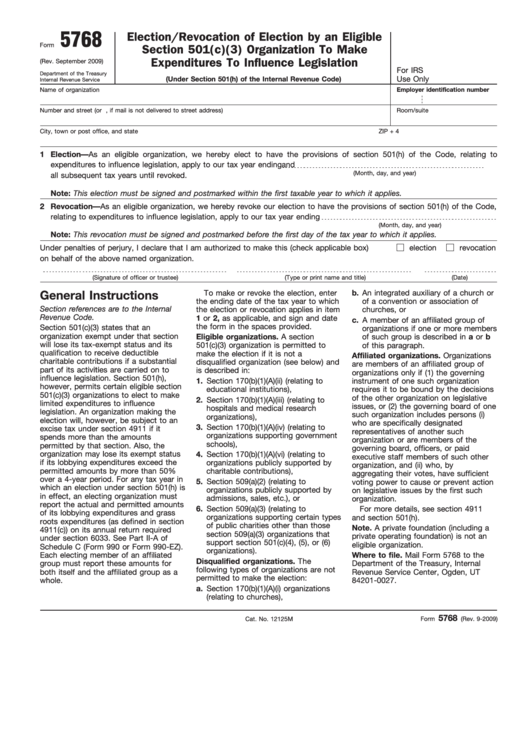

5768

Election/Revocation of Election by an Eligible

Form

Section 501(c)(3) Organization To Make

Expenditures To Influence Legislation

(Rev. September 2009)

For IRS

Department of the Treasury

Use Only

(Under Section 501(h) of the Internal Revenue Code)

Internal Revenue Service

Name of organization

Employer identification number

Number and street (or P.O. box no., if mail is not delivered to street address)

Room/suite

City, town or post office, and state

ZIP + 4

1

Election—As an eligible organization, we hereby elect to have the provisions of section 501(h) of the Code, relating to

expenditures to influence legislation, apply to our tax year ending

and

(Month, day, and year)

all subsequent tax years until revoked.

Note: This election must be signed and postmarked within the first taxable year to which it applies.

2

Revocation—As an eligible organization, we hereby revoke our election to have the provisions of section 501(h) of the Code,

relating to expenditures to influence legislation, apply to our tax year ending

(Month, day, and year)

Note: This revocation must be signed and postmarked before the first day of the tax year to which it applies.

Under penalties of perjury, I declare that I am authorized to make this (check applicable box)

election

revocation

on behalf of the above named organization.

(Signature of officer or trustee)

(Type or print name and title)

(Date)

To make or revoke the election, enter

b. An integrated auxiliary of a church or

General Instructions

the ending date of the tax year to which

of a convention or association of

Section references are to the Internal

the election or revocation applies in item

churches, or

Revenue Code.

1 or 2, as applicable, and sign and date

c. A member of an affiliated group of

the form in the spaces provided.

Section 501(c)(3) states that an

organizations if one or more members

organization exempt under that section

Eligible organizations. A section

of such group is described in a or b

will lose its tax-exempt status and its

501(c)(3) organization is permitted to

of this paragraph.

qualification to receive deductible

make the election if it is not a

Affiliated organizations. Organizations

charitable contributions if a substantial

disqualified organization (see below) and

are members of an affiliated group of

part of its activities are carried on to

is described in:

organizations only if (1) the governing

influence legislation. Section 501(h),

1. Section 170(b)(1)(A)(ii) (relating to

instrument of one such organization

however, permits certain eligible section

educational institutions),

requires it to be bound by the decisions

501(c)(3) organizations to elect to make

of the other organization on legislative

2. Section 170(b)(1)(A)(iii) (relating to

limited expenditures to influence

issues, or (2) the governing board of one

hospitals and medical research

legislation. An organization making the

such organization includes persons (i)

organizations),

election will, however, be subject to an

who are specifically designated

3. Section 170(b)(1)(A)(iv) (relating to

excise tax under section 4911 if it

representatives of another such

organizations supporting government

spends more than the amounts

organization or are members of the

schools),

permitted by that section. Also, the

governing board, officers, or paid

organization may lose its exempt status

4. Section 170(b)(1)(A)(vi) (relating to

executive staff members of such other

if its lobbying expenditures exceed the

organizations publicly supported by

organization, and (ii) who, by

permitted amounts by more than 50%

charitable contributions),

aggregating their votes, have sufficient

over a 4-year period. For any tax year in

5. Section 509(a)(2) (relating to

voting power to cause or prevent action

which an election under section 501(h) is

organizations publicly supported by

on legislative issues by the first such

in effect, an electing organization must

admissions, sales, etc.), or

organization.

report the actual and permitted amounts

6. Section 509(a)(3) (relating to

For more details, see section 4911

of its lobbying expenditures and grass

organizations supporting certain types

and section 501(h).

roots expenditures (as defined in section

of public charities other than those

Note. A private foundation (including a

4911(c)) on its annual return required

section 509(a)(3) organizations that

private operating foundation) is not an

under section 6033. See Part II-A of

support section 501(c)(4), (5), or (6)

eligible organization.

Schedule C (Form 990 or Form 990-EZ).

organizations).

Each electing member of an affiliated

Where to file. Mail Form 5768 to the

Disqualified organizations. The

group must report these amounts for

Department of the Treasury, Internal

following types of organizations are not

both itself and the affiliated group as a

Revenue Service Center, Ogden, UT

permitted to make the election:

whole.

84201-0027.

a. Section 170(b)(1)(A)(i) organizations

(relating to churches),

5768

Cat. No. 12125M

Form

(Rev. 9-2009)

1

1