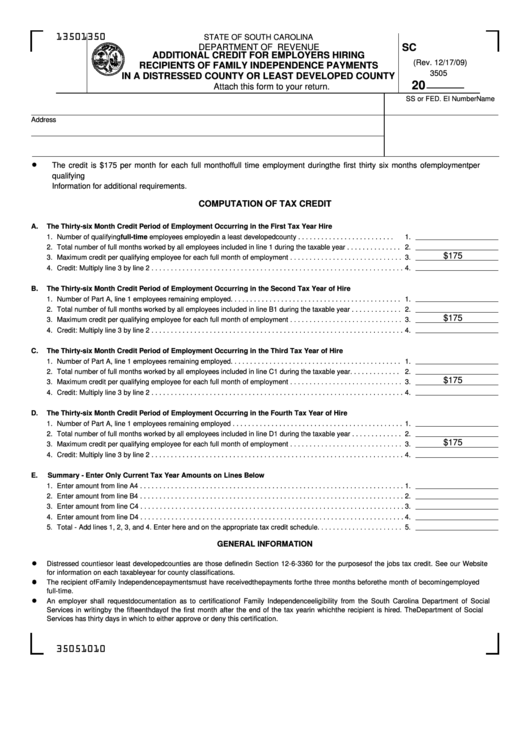

Form Sc Sch.tc-12-A - South Carolina Additional Credit For Employers Hiring Recipients Of Family Independence Payments In A Distressed County Or Least Developed County

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

SC SCH.TC-12-A

DEPARTMENT OF REVENUE

ADDITIONAL CREDIT FOR EMPLOYERS HIRING

(Rev. 12/17/09)

RECIPIENTS OF FAMILY INDEPENDENCE PAYMENTS

3505

IN A DISTRESSED COUNTY OR LEAST DEVELOPED COUNTY

20

Attach this form to your return.

Name

SS or FED. EI Number

Address

The credit is $175 per month for each full month of full time employment during the first thirty six months of employment per

qualifying employee. Note that the employment must be full time as per South Carolina Code Section 12-6-3360. See General

Information for additional requirements.

COMPUTATION OF TAX CREDIT

A.

The Thirty-six Month Credit Period of Employment Occurring in the First Tax Year Hire

1.

Number of qualifying full-time employees employed in a least developed county . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Total number of full months worked by all employees included in line 1 during the taxable year . . . . . . . . . . . . . .

2.

$175

3.

Maximum credit per qualifying employee for each full month of employment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Credit: Multiply line 3 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

B.

The Thirty-six Month Credit Period of Employment Occurring in the Second Tax Year of Hire

1.

Number of Part A, line 1 employees remaining employed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Total number of full months worked by all employees included in line B1 during the taxable year . . . . . . . . . . . . .

2.

$175

3.

Maximum credit per qualifying employee for each full month of employment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Credit: Multiply line 3 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

C.

The Thirty-six Month Credit Period of Employment Occurring in the Third Tax Year of Hire

1.

Number of Part A, line 1 employees remaining employed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Total number of full months worked by all employees included in line C1 during the taxable year. . . . . . . . . . . . .

2.

$175

3.

Maximum credit per qualifying employee for each full month of employment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Credit: Multiply line 3 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

D.

The Thirty-six Month Credit Period of Employment Occurring in the Fourth Tax Year of Hire

1.

Number of Part A, line 1 employees remaining employed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Total number of full months worked by all employees included in line D1 during the taxable year . . . . . . . . . . . . .

2.

$175

3.

Maximum credit per qualifying employee for each full month of employment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Credit: Multiply line 3 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

E.

Summary - Enter Only Current Tax Year Amounts on Lines Below

1.

Enter amount from line A4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Enter amount from line B4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Enter amount from line C4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Enter amount from line D4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5.

Total - Add lines 1, 2, 3, and 4. Enter here and on the appropriate tax credit schedule. . . . . . . . . . . . . . . . . . . . . .

5.

GENERAL INFORMATION

Distressed counties or least developed counties are those defined in Section 12-6-3360 for the purposes of the jobs tax credit. See our Website

for information on each taxable year for county classifications.

The recipient of Family Independence payments must have received the payments for the three months before the month of becoming employed

full-time.

An employer shall request documentation as to certification of Family Independence eligibility from the South Carolina Department of Social

Services in writing by the fifteenth day of the first month after the end of the tax year in which the recipient is hired. The Department of Social

Services has thirty days in which to either approve or deny this certification.

35051010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2