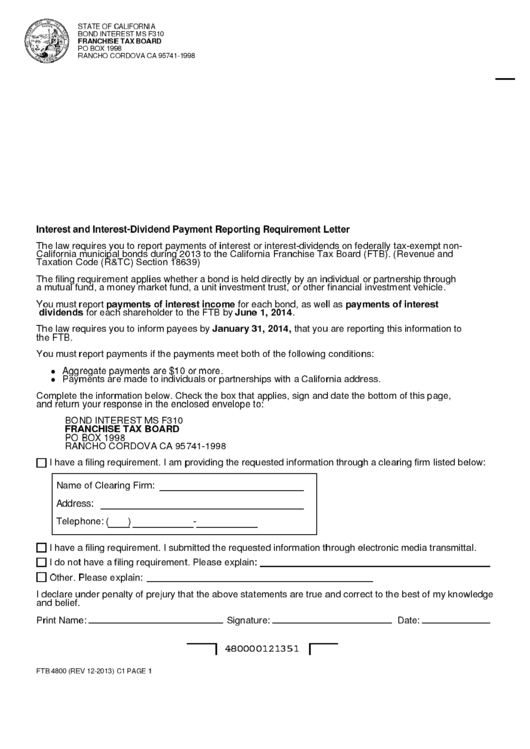

Form Ftb 4800 - Interest And Interest-Dividend Payment Reporting Requirement Letter

ADVERTISEMENT

STATE OF CALIFORNIA

BOND INTEREST MS F310

FRANCHISE TAX BOARD

PO BOX 1998

RANCHO CORDOVA CA 95741-1998

Interest and Interest-Dividend Payment Reporting Requirement Letter

The law requires you to report payments of interest or interest-dividends on federally tax-exempt non-

California municipal bonds during 2013 to the California Franchise Tax Board (FTB). (Revenue and

Taxation Code (R&TC) Section 18639)

The filing requirement applies whether a bond is held directly by an individual or partnership through

a mutual fund, a money market fund, a unit investment trust, or other financial investment vehicle.

You must report payments of interest income for each bond, as well as payments of interest

dividends for each shareholder to the FTB by June 1, 2014.

The law requires you to inform payees by January 31, 2014, that you are reporting this information to

the FTB.

You must report payments if the payments meet both of the following conditions:

Aggregate payments are $10 or more.

●

Payments are made to individuals or partnerships with a California address.

●

Complete the information below. Check the box that applies, sign and date the bottom of this page,

and return your response in the enclosed envelope to:

BOND INTEREST MS F310

FRANCHISE TAX BOARD

PO BOX 1998

RANCHO CORDOVA CA 95741-1998

I have a filing requirement. I am providing the requested information through a clearing firm listed below:

Name of Clearing Firm:

Address:

Telephone: (

)

-

I have a filing requirement. I submitted the requested information through electronic media transmittal.

I do not have a filing requirement. Please explain:

Other. Please explain:

I declare under penalty of prejury that the above statements are true and correct to the best of my knowledge

and belief.

Print Name:

Signature:

Date:

480000121351

FTB 4800 (REV 12-2013) C1 PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4