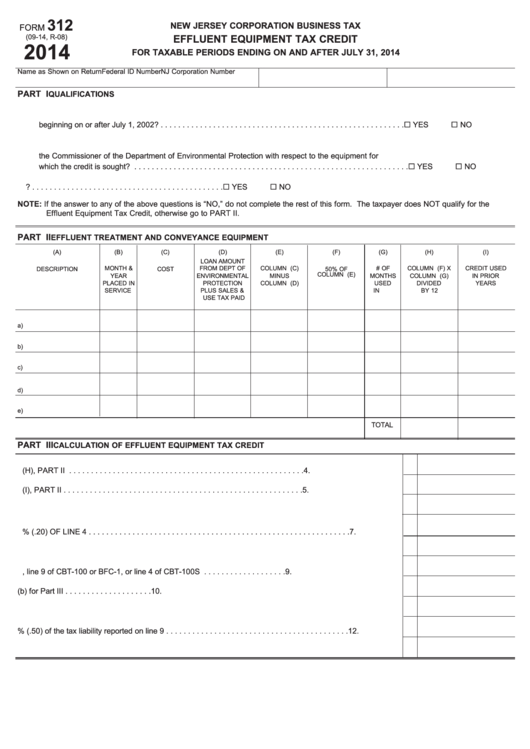

312

NEW JERSEY CORPORATION BUSINESS TAX

FORM

EFFLUENT EQUIPMENT TAX CREDIT

(09-14, R-08)

2014

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2014

Name as Shown on Return

Federal ID Number

NJ Corporation Number

PART I

QUALIFICATIONS

1. Did the taxpayer purchase the effluent treatment equipment or conveyance equipment in a tax period

¨ NO

beginning on or after July 1, 2002? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .¨ YES

2. Has the taxpayer applied for or received a determination of environmentally beneficial operation from

the Commissioner of the Department of Environmental Protection with respect to the equipment for

¨ NO

which the credit is sought? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .¨ YES

¨ NO

3. Is the equipment used exclusively in New Jersey? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .¨ YES

NOTE: If the answer to any of the above questions is “NO,” do not complete the rest of this form. The taxpayer does NOT qualify for the

Effluent Equipment Tax Credit, otherwise go to PART II.

PART II

EFFLUENT TREATMENT AND CONVEYANCE EQUIPMENT

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

LOAN AMOUNT

MONTH &

FROM DEPT OF

COLUMN (C)

# OF

COLUMN (F) X

CREDIT USED

DESCRIPTION

COST

50% OF

COLUMN (E)

YEAR

ENVIRONMENTAL

MINUS

MONTHS

COLUMN (G)

IN PRIOR

PLACED IN

PROTECTION

COLUMN (D)

USED

DIVIDED

YEARS

SERVICE

PLUS SALES &

IN N.J.

BY 12

USE TAX PAID

a)

b)

c)

d)

e)

TOTAL

PART III

CALCULATION OF EFFLUENT EQUIPMENT TAX CREDIT

4. Enter the total of column (H), PART II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Enter the total of column (I), PART II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. ENTER 20% (.20) OF LINE 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Enter the lesser of line 6 or line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Enter tax liability from page 1, line 9 of CBT-100 or BFC-1, or line 4 of CBT-100S . . . . . . . . . . . . . . . . . . .

9.

10. Enter the required minimum tax liability as indicated in instruction (b) for Part III . . . . . . . . . . . . . . . . . . . . 10.

11. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Enter 50% (.50) of the tax liability reported on line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Enter the lesser of line 11 or line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

1

1 2

2 3

3