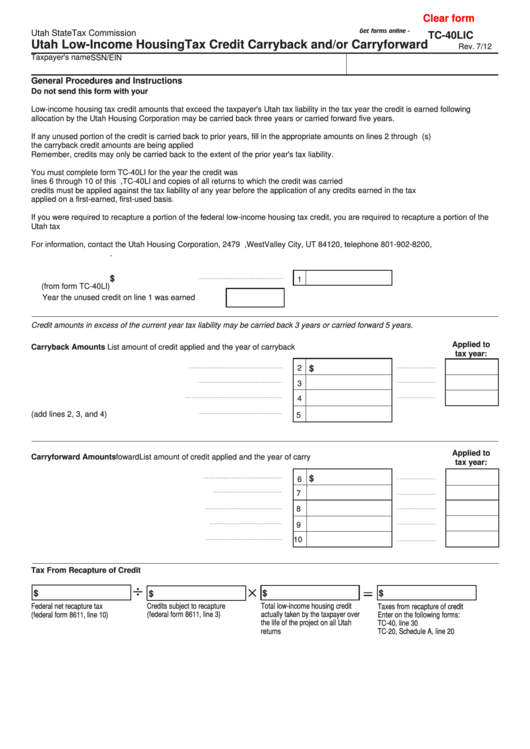

Clear form

Get forms online - tax.utah.gov

Utah State Tax Commission

TC-40LIC

Utah Low-Income Housing Tax Credit Carryback and/or Carryforward

Rev. 7/12

Taxpayer's name

SSN/EIN

General Procedures and Instructions

Do not send this form with your return. Keep this form and all related documents with your records.

Low-income housing tax credit amounts that exceed the taxpayer's Utah tax liability in the tax year the credit is earned following

allocation by the Utah Housing Corporation may be carried back three years or carried forward five years.

If any unused portion of the credit is carried back to prior years, fill in the appropriate amounts on lines 2 through 5. Include the year(s)

the carryback credit amounts are being applied against. An amended return should be filed for each year to which credit is carried back.

Remember, credits may only be carried back to the extent of the prior year's tax liability.

You must complete form TC-40LI for the year the credit was earned. The appropriate amounts of any carryforward must be entered on

lines 6 through 10 of this form. Keep this form, TC-40LI and copies of all returns to which the credit was carried forward. Carryforward

credits must be applied against the tax liability of any year before the application of any credits earned in the tax year. Credits are

applied on a first-earned, first-used basis.

If you were required to recapture a portion of the federal low-income housing tax credit, you are required to recapture a portion of the

Utah tax credit. Use this form to calculate the recapture tax of the low-income housing credit.

For information, contact the Utah Housing Corporation, 2479 S. Lake Park Blvd., West Valley City, UT 84120, telephone 801-902-8200,

.

1. Credit available to carry back or carry forward

$

1

(from form TC-40LI)

Year the unused credit on line 1 was earned

Credit amounts in excess of the current year tax liability may be carried back 3 years or carried forward 5 years.

Applied to

Carryback Amounts List amount of credit applied and the year of carryback

tax year:

2. Amount of credit applied to third prior year

2

$

3. Amount of credit applied to second prior year

3

4. Amount of credit applied to first prior year

4

5. Total credit carried back (add lines 2, 3, and 4)

5

Applied to

Carryforward Amounts

List amount of credit applied and the year of carry

foward

tax year:

6. Amount of tax credit carried forward - first year

$

6

7. Amount of tax credit carried forward - second year

7

8. Amount of tax credit carried forward - third year

8

9. Amount of tax credit carried forward - fourth year

9

10. Amount of tax credit carried forward - fifth year

10

Tax From Recapture of Credit

$

$

$

$

Total low-income housing credit

Federal net recapture tax

Credits subject to recapture

Taxes from recapture of credit

(federal form 8611, line 10)

(federal form 8611, line 3)

actually taken by the taxpayer over

Enter on the following forms:

the life of the project on all Utah

TC-40, line 30

returns

TC-20, Schedule A, line 20

1

1