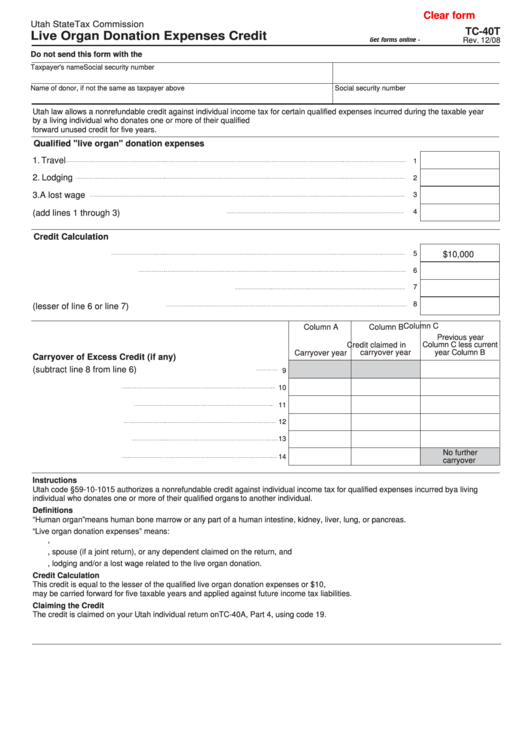

Clear form

Utah State Tax Commission

TC-40T

Live Organ Donation Expenses Credit

Get forms online - tax.utah.gov

Rev. 12/08

Do not send this form with the return. Keep this form and all related documents with your records.

Taxpayer's name

Social security number

Name of donor, if not the same as taxpayer above

Social security number

Utah law allows a nonrefundable credit against individual income tax for certain qualified expenses incurred during the taxable year

by a living individual who donates one or more of their qualified organs. Use this form to calculate the allowable credit and to carry

forward unused credit for five years.

Qualified "live organ" donation expenses

1. Travel

1

2. Lodging

2

3. A lost wage

3

4

4. Total qualified expenses (add lines 1 through 3)

Credit Calculation

5. Maximum credit

5

$10,000

6. Lesser of line 4 or line 5

6

7

7. Tax after other nonrefundable credits from TC-40

8

8. Credit (lesser of line 6 or line 7)

Column C

Column A

Column B

Previous year

Credit claimed in

Column C less current

Carryover year

carryover year

year Column B

Carryover of Excess Credit (if any)

9. Carryover from original year (subtract line 8 from line 6)

9

10. First carryover year

10

11. Second carryover year

11

12. Third carryover year

12

13. Fourth carryover year

13

No further

14. Fifth carryover year

14

carryover

Instructions

Utah code §59-10-1015 authorizes a nonrefundable credit against individual income tax for qualified expenses incurred by

a living

individual who donates one or more of their qualified organs

to another individual.

Definitions

“Human organ” means human bone marrow or any part of a human intestine, kidney, liver, lung, or pancreas.

“Live organ donation expenses” means:

1.

The total unreimbursed expenses incurred by the taxpayer,

2.

Directly related to a live organ donation by the taxpayer, spouse (if a joint return), or any dependent claimed on the return, and

3.

For travel, lodging and/or a lost wage related to the live organ donation.

Credit Calculation

This credit is equal to the lesser of the qualified live organ donation expenses or $10,000. Any credit in excess of the current tax liability

may be carried forward for five taxable years and applied against future income tax liabilities.

Claiming the Credit

The credit is claimed on your Utah individual return on TC-40A, Part 4, using code 19.

1

1