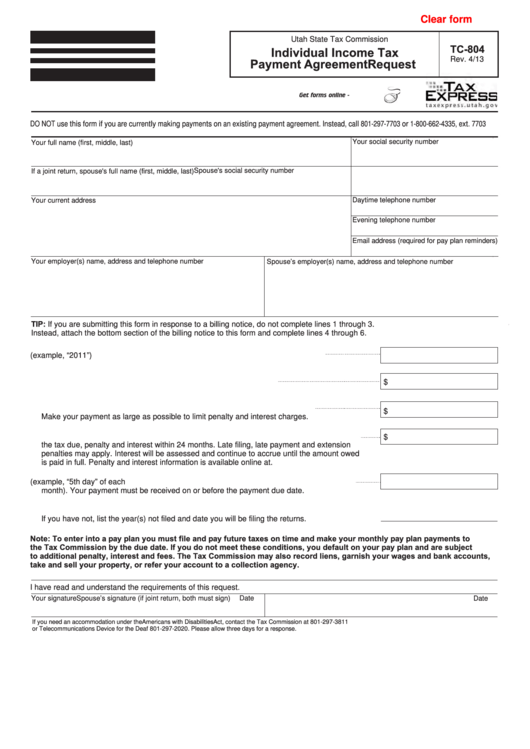

Clear form

Utah State Tax Commission

TC-804

Individual Income Tax

Rev. 4/13

Payment Agreement Request

Get forms online - tax.utah.gov

DO NOT use this form if you are currently making payments on an existing payment agreement. Instead, call 801-297-7703 or 1-800-662-4335, ext. 7703

Your social security number

Your full name (first, middle, last)

Spouse's social security number

If a joint return, spouse's full name (first, middle, last)

Your current address

Daytime telephone number

Evening telephone number

Email address (required for pay plan reminders)

Your employer(s) name, address and telephone number

Spouse’s employer(s) name, address and telephone number

TIP: If you are submitting this form in response to a billing notice, do not complete lines 1 through 3.

Instead, attach the bottom section of the billing notice to this form and complete lines 4 through 6.

1. Enter the income tax year for which you are making this request (example, “2011”)

2. Enter the total amount you owe as shown on your income tax return

$

3. Enter the amount of any payment you are making with your tax return or notice.

$

Make your payment as large as possible to limit penalty and interest charges.

4. Enter the amount you can pay each month. Your payment should be large enough to pay off

$

the tax due, penalty and interest within 24 months. Late filing, late payment and extension

penalties may apply. Interest will be assessed and continue to accrue until the amount owed

is paid in full. Penalty and interest information is available online at

incometax.utah.gov

.

5. Enter the day of the month you want your payments to be due (example, “5th day” of each

month). Your payment must be received on or before the payment due date.

6. You must have filed income tax returns for all prior years before your pay

plan

will be approved.

If you have not, list the year(s) not filed and date you will be filing the returns.

Note: To enter into a pay plan you must file and pay future taxes on time and make your monthly pay plan payments to

the Tax Commission by the due date. If you do not meet these conditions, you default on your pay plan and are subject

to additional penalty, interest and fees. The Tax Commission may also record liens, garnish your wages and bank accounts,

take and sell your property, or refer your account to a collection agency.

I have read and understand the requirements of this request.

Date

Date

Your signature

Spouse’s signature (if joint return, both must sign)

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at 801-297-3811

or Telecommunications Device for the Deaf 801-297-2020. Please allow three days for a response.

1

1 2

2