Form Nys-100 - New York State Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting

ADVERTISEMENT

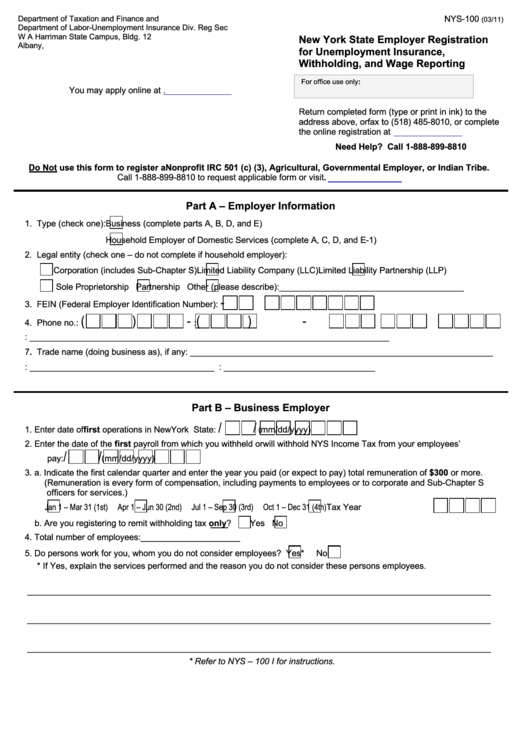

Department of Taxation and Finance and

NYS-100

(03/11)

Department of Labor-Unemployment Insurance Div. Reg Sec

W A Harriman State Campus, Bldg. 12

New York State Employer Registration

Albany, N.Y. 12240-0339

for Unemployment Insurance,

Withholding, and Wage Reporting

For office use only:

You may apply online at

U.I. Employer Registration No.

Return completed form (type or print in ink) to the

address above, or fax to (518) 485-8010, or complete

the online registration at

Need Help? Call 1-888-899-8810

Do Not use this form to register a Nonprofit IRC 501 (c) (3), Agricultural, Governmental Employer, or Indian Tribe.

Call 1-888-899-8810 to request applicable form or visit

Part A – Employer Information

1. Type (check one):

Business (complete parts A, B, D, and E)

Household Employer of Domestic Services (complete A, C, D, and E-1)

2. Legal entity (check one – do not complete if household employer):

Corporation (includes Sub-Chapter S)

Limited Liability Company (LLC)

Limited Liability Partnership (LLP)

Sole Proprietorship

Partnership

Other (please describe):_______________________________________

-

3. FEIN (Federal Employer Identification Number):

(

)

-

(

)

-

4. Phone no.:

5. Fax no.:

6. Legal name of business: ____________________________________________________________________________

7. Trade name (doing business as), if any: ________________________________________________________________

8. Business e-mail: _______________________________________ 9. Website: ________________________________

Part B – Business Employer

/

/

1. Enter date of first operations in New York State:

(mm/dd/yyyy)

2. Enter the date of the first payroll from which you withheld or will withhold NYS Income Tax from your employees’

/

/

pay:

(mm/dd/yyyy)

3. a. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total remuneration of $300 or more.

(Remuneration is every form of compensation, including payments to employees or to corporate and Sub-Chapter S

officers for services.)

Jan 1 – Mar 31 (1st)

Apr 1 – Jun 30 (2nd)

Jul 1 – Sep 30 (3rd)

Oct 1 – Dec 31 (4th)

Tax Year

b. Are you registering to remit withholding tax only?

Yes

No

4. Total number of employees:_____________________

5. Do persons work for you, whom you do not consider employees?

Yes*

No

* If Yes, explain the services performed and the reason you do not consider these persons employees.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

* Refer to NYS – 100 I for instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3