Instructions For Form Sc1040tc - Tax Credits

ADVERTISEMENT

(Rev. 8/10/11)

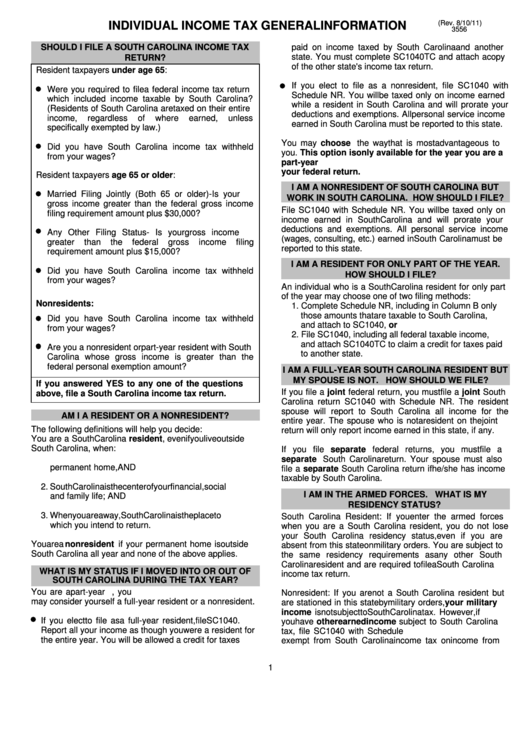

INDIVIDUAL INCOME TAX GENERAL INFORMATION

3556

SHOULD I FILE A SOUTH CAROLINA INCOME TAX

paid on income taxed by South Carolina and another

state. You must complete SC1040TC and attach a copy

RETURN?

of the other state's income tax return.

Resident taxpayers under age 65:

If you elect to file as a nonresident, file SC1040 with

Were you required to file a federal income tax return

Schedule NR. You will be taxed only on income earned

which included income taxable by South Carolina?

while a resident in South Carolina and will prorate your

(Residents of South Carolina are taxed on their entire

deductions and exemptions. All personal service income

income,

regardless

of

where

earned,

unless

earned in South Carolina must be reported to this state.

specifically exempted by law.)

You may choose the way that is most advantageous to

Did you have South Carolina income tax withheld

you. This option is only available for the year you are a

from your wages?

part-year resident. You must also attach a copy of

your federal return.

Resident taxpayers age 65 or older:

I AM A NONRESIDENT OF SOUTH CAROLINA BUT

Married Filing Jointly (Both 65 or older) - Is your

WORK IN SOUTH CAROLINA. HOW SHOULD I FILE?

gross income greater than the federal gross income

File SC1040 with Schedule NR. You will be taxed only on

filing requirement amount plus $30,000?

income earned in South Carolina and will prorate your

deductions and exemptions. All personal service income

Any Other Filing Status - Is your gross income

(wages, consulting, etc.) earned in South Carolina must be

greater

than

the

federal

gross

income

filing

reported to this state.

requirement amount plus $15,000?

I AM A RESIDENT FOR ONLY PART OF THE YEAR.

Did you have South Carolina income tax withheld

HOW SHOULD I FILE?

from your wages?

An individual who is a South Carolina resident for only part

of the year may choose one of two filing methods:

Nonresidents:

1. Complete Schedule NR, including in Column B only

those amounts that are taxable to South Carolina,

Did you have South Carolina income tax withheld

and attach to SC1040, or

from your wages?

2. File SC1040, including all federal taxable income,

and attach SC1040TC to claim a credit for taxes paid

Are you a nonresident or part-year resident with South

to another state.

Carolina whose gross income is greater than the

federal personal exemption amount?

I AM A FULL-YEAR SOUTH CAROLINA RESIDENT BUT

MY SPOUSE IS NOT. HOW SHOULD WE FILE?

If you answered YES to any one of the questions

If you file a joint federal return, you must file a joint South

above, file a South Carolina income tax return.

Carolina return SC1040 with Schedule NR. The resident

spouse will report to South Carolina all income for the

AM I A RESIDENT OR A NONRESIDENT?

entire year. The spouse who is not a resident on the joint

The following definitions will help you decide:

return will only report income earned in this state, if any.

You are a South Carolina resident, even if you live outside

South Carolina, when:

If you file separate federal returns, you must file a

1. Your intention is to maintain South Carolina as your

separate South Carolina return. Your spouse must also

permanent home, AND

file a separate South Carolina return if he/she has income

taxable by South Carolina.

2. South Carolina is the center of your financial, social

I AM IN THE ARMED FORCES. WHAT IS MY

and family life; AND

RESIDENCY STATUS?

3. When you are away, South Carolina is the place to

South Carolina Resident: If you enter the armed forces

which you intend to return.

when you are a South Carolina resident, you do not lose

your South Carolina residency status, even if you are

You are a nonresident if your permanent home is outside

absent from this state on military orders. You are subject to

South Carolina all year and none of the above applies.

the same residency requirements as any other South

Carolina resident and are required to file a South Carolina

WHAT IS MY STATUS IF I MOVED INTO OR OUT OF

income tax return.

SOUTH CAROLINA DURING THE TAX YEAR?

You are a part-year resident. As a part-year resident, you

Nonresident: If you are not a South Carolina resident but

may consider yourself a full-year resident or a nonresident.

are stationed in this state by military orders, your military

income is not subject to South Carolina tax. However, if

If you elect to file as a full-year resident, file SC1040.

you have other earned income subject to South Carolina

Report all your income as though you were a resident for

tax, file SC1040 with Schedule NR. Your spouse may be

the entire year. You will be allowed a credit for taxes

exempt from South Carolina income tax on income from

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3