Form Sc1120-T - Corporate Tax Credits

ADVERTISEMENT

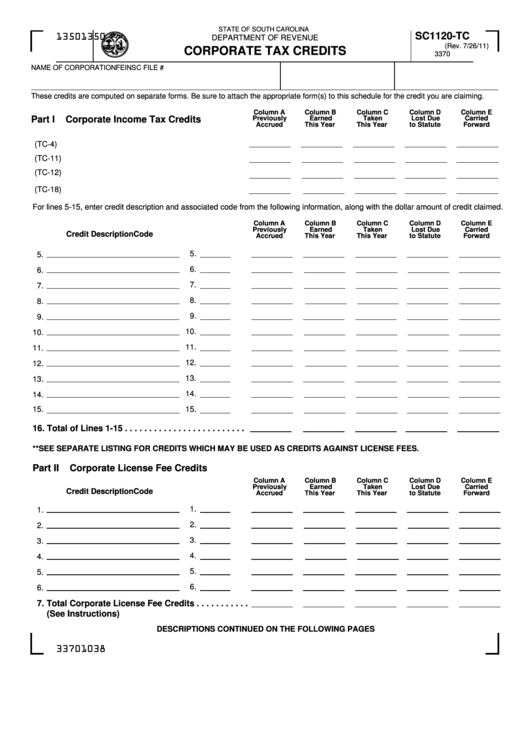

STATE OF SOUTH CAROLINA

SC1120-TC

1350

1350

DEPARTMENT OF REVENUE

(Rev. 7/26/11)

CORPORATE TAX CREDITS

3370

NAME OF CORPORATION

FEIN

SC FILE #

These credits are computed on separate forms. Be sure to attach the appropriate form(s) to this schedule for the credit you are claiming.

Column A

Column B

Column C

Column D

Column E

Part I

Corporate Income Tax Credits

Previously

Earned

Taken

Lost Due

Carried

Accrued

This Year

This Year

to Statute

Forward

1. New Jobs Credit (TC-4)

2. Capital Investment Credit (TC-11)

3. Family Independence Payments Credit (TC-12)

4. Research Expenses Credit (TC-18)

For lines 5-15, enter credit description and associated code from the following information, along with the dollar amount of credit claimed.

Column A

Column B

Column C

Column D

Column E

Previously

Earned

Taken

Lost Due

Carried

Credit Description

Code

Accrued

This Year

This Year

to Statute

Forward

5.

5.

6.

6.

7.

7.

8.

8.

9.

9.

10.

10.

11.

11.

12.

12.

13.

13.

14.

14.

15.

15.

16. Total of Lines 1-15 . . . . . . . . . . . . . . . . . . . . . . . . .

**SEE SEPARATE LISTING FOR CREDITS WHICH MAY BE USED AS CREDITS AGAINST LICENSE FEES.

Part II

Corporate License Fee Credits

Column A

Column B

Column C

Column D

Column E

Previously

Earned

Taken

Lost Due

Carried

Credit Description

Code

Accrued

This Year

This Year

to Statute

Forward

1.

1.

2.

2.

3.

3.

4.

4.

5.

5.

6.

6.

7. Total Corporate License Fee Credits . . . . . . . . . . .

(See Instructions)

DESCRIPTIONS CONTINUED ON THE FOLLOWING PAGES

33701038

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3