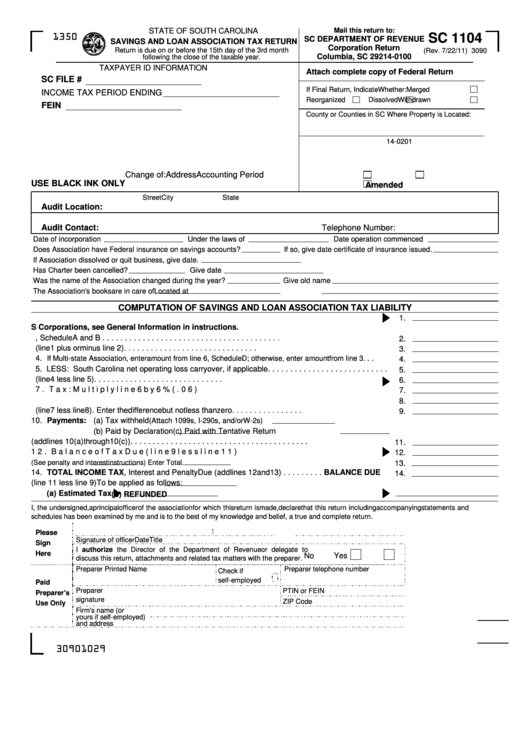

Form Sc 1104 - South Carolina Savings And Loan Association Tax Return

ADVERTISEMENT

Mail this return to:

STATE OF SOUTH CAROLINA

SC 1104

1350

SC DEPARTMENT OF REVENUE

SAVINGS AND LOAN ASSOCIATION TAX RETURN

Corporation Return

Return is due on or before the 15th day of the 3rd month

(Rev. 7/22/11) 3090

Columbia, SC 29214-0100

following the close of the taxable year.

TAXPAYER ID INFORMATION

Attach complete copy of Federal Return

SC FILE #

If Final Return, Indicate Whether:

Merged

INCOME TAX PERIOD ENDING

Reorganized

Dissolved

Withdrawn

FEIN

County or Counties in SC Where Property is Located:

14-0201

Change of:

Address

Accounting Period

USE BLACK INK ONLY

Amended

Street

City

State

Audit Location:

Audit Contact:

Telephone Number:

Date of incorporation

Under the laws of

Date operation commenced

Does Association have Federal insurance on savings accounts?

If so, give date certificate of insurance issued.

If Association dissolved or quit business, give date.

Has Charter been cancelled?

Give date

Was the name of the Association changed during the year?

Give old name

The Association's books are in care of

Located at

COMPUTATION OF SAVINGS AND LOAN ASSOCIATION TAX LIABILITY

1. Federal Taxable Income per federal tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

S Corporations, see General Information in instructions.

2. Net Adjustment from line 12, Schedule A and B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Total Net Income As Reconciled (line 1 plus or minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

. .

If Multi-state Association, enter amount from line 6, Schedule D; otherwise, enter amount from line 3.

4.

5. LESS: South Carolina net operating loss carryover, if applicable. . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. South Carolina Net Income subject to tax (line 4 less line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Tax: Multiply line 6 by 6% (.06). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Non Refundable Credits Taken This year from SC 1120-TC. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Balance of Tax (line 7 less line 8). Enter the difference but not less than zero . . . . . . . . . . . . . . . .

9.

10. Payments: (a) Tax withheld

(Attach 1099s, I-290s, and/or W-2s)

(b) Paid by Declaration

(c) Paid with Tentative Return

11. Total Payments (add lines 10(a) through 10(c)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Balance of Tax Due (line 9 less line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Interest Due

Penalty Due

.

(See penalty and interest instructions) Enter Total

13.

14. TOTAL INCOME TAX, Interest and Penalty Due (add lines 12 and 13) . . . . . . . . . BALANCE DUE

14.

15. Overpayment (line 11 less line 9)

To be applied as follows:

(a) Estimated Tax

(b) REFUNDED

I, the undersigned, a principal officer of the association for which this return is made, declare that this return including accompanying statements and

schedules has been examined by me and is to the best of my knowledge and belief, a true and complete return.

Please

Signature of officer

Date

Title

Sign

I authorize the Director of the Department of Revenue or delegate to

Here

Yes

No

discuss this return, attachments and related tax matters with the preparer.

Preparer Printed Name

Preparer telephone number

Check if

self-employed

Paid

Preparer

PTIN or FEIN

Preparer's

signature

ZIP Code

Use Only

Firm's name (or

yours if self-employed)

and address

30901029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4