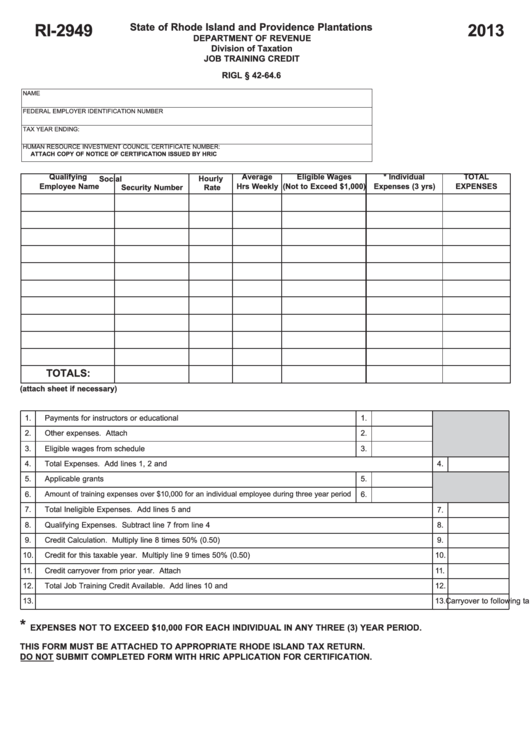

State of Rhode Island and Providence Plantations

RI-2949

2013

DEPARTMENT OF REVENUE

Division of Taxation

JOB TRAINING CREDIT

RIGL § 42-64.6

NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

TAX YEAR ENDING:

HUMAN RESOURCE INVESTMENT COUNCIL CERTIFICATE NUMBER:

ATTACH COPY OF NOTICE OF CERTIFICATION ISSUED BY HRIC

Qualifying

Average

Eligible Wages

* Individual

TOTAL

Social

Hourly

Employee Name

Hrs Weekly

(Not to Exceed $1,000)

Expenses (3 yrs)

EXPENSES

Security Number

Rate

TOTALS:

(attach sheet if necessary)

1.

Payments for instructors or educational institutions.................................................................

1.

2.

Other expenses. Attach schedule............................................................................................

2.

3.

Eligible wages from schedule above........................................................................................

3.

4.

Total Expenses. Add lines 1, 2 and 3..........................................................................................................................

4.

5.

Applicable grants received........................................................................................................

5.

6.

6.

Amount of training expenses over $10,000 for an individual employee during three year period

7.

Total Ineligible Expenses. Add lines 5 and 6...............................................................................................................

7.

8.

Qualifying Expenses. Subtract line 7 from line 4 ........................................................................................................

8.

9.

Credit Calculation. Multiply line 8 times 50% (0.50)....................................................................................................

9.

10.

Credit for this taxable year. Multiply line 9 times 50% (0.50)......................................................................................

10.

11.

Credit carryover from prior year. Attach schedule.......................................................................................................

11.

12.

Total Job Training Credit Available. Add lines 10 and 11.............................................................................................

12.

13.

Carryover to following taxable year. Multiply line 9 times 50% (0.50).........................................................................

13.

*

EXPENSES NOT TO EXCEED $10,000 FOR EACH INDIVIDUAL IN ANY THREE (3) YEAR PERIOD.

THIS FORM MUST BE ATTACHED TO APPROPRIATE RHODE ISLAND TAX RETURN.

DO NOT SUBMIT COMPLETED FORM WITH HRIC APPLICATION FOR CERTIFICATION.

1

1