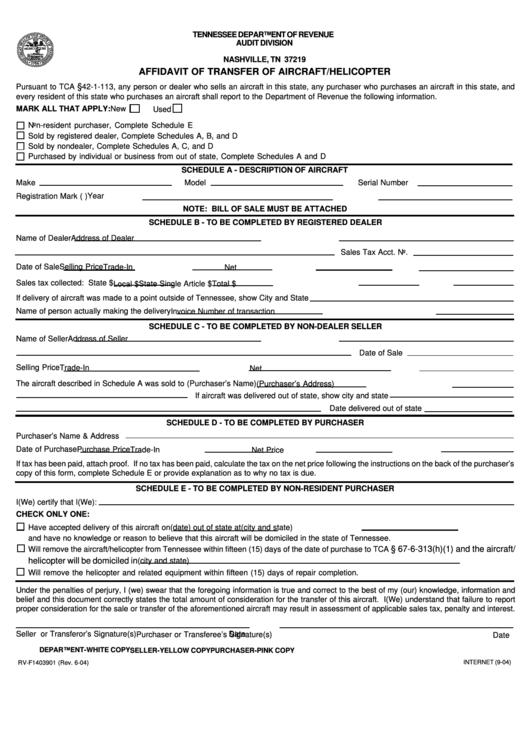

TENNESSEE DEPARTMENT OF REVENUE

AUDIT DIVISION

P.O. BOX 190644

NASHVILLE, TN 37219

AFFIDAVIT OF TRANSFER OF AIRCRAFT/HELICOPTER

§

Pursuant to TCA

42-1-113, any person or dealer who sells an aircraft in this state, any purchaser who purchases an aircraft in this state, and

every resident of this state who purchases an aircraft shall report to the Department of Revenue the following information.

MARK ALL THAT APPLY:

New

Used

Non-resident purchaser, Complete Schedule E

Sold by registered dealer, Complete Schedules A, B, and D

Sold by nondealer, Complete Schedules A, C, and D

Purchased by individual or business from out of state, Complete Schedules A and D

SCHEDULE A - DESCRIPTION OF AIRCRAFT

Make

Model

Serial Number

Year

Registration Mark (F.A.A. Number)

NOTE: BILL OF SALE MUST BE ATTACHED

SCHEDULE B - TO BE COMPLETED BY REGISTERED DEALER

Name of Dealer

Address of Dealer

Sales Tax Acct. No.

Date of Sale

Selling Price

Trade-In

Net

Sales tax collected: State $

Local $

State Single Article $

Total $

If delivery of aircraft was made to a point outside of Tennessee, show City and State

Name of person actually making the delivery

Invoice Number of transaction

SCHEDULE C - TO BE COMPLETED BY NON-DEALER SELLER

Name of Seller

Address of Seller

Date of Sale

Selling Price

Trade-In

Net

The aircraft described in Schedule A was sold to (Purchaser’s Name)

(Purchaser’s Address)

If aircraft was delivered out of state, show city and state

Date delivered out of state

SCHEDULE D - TO BE COMPLETED BY PURCHASER

Purchaser’s Name & Address

Date of Purchase

Purchase Price

Trade-In

Net Price

If tax has been paid, attach proof. If no tax has been paid, calculate the tax on the net price following the instructions on the back of the purchaser’s

copy of this form, complete Schedule E or provide explanation as to why no tax is due.

SCHEDULE E - TO BE COMPLETED BY NON-RESIDENT PURCHASER

I(We) certify that I(We):

CHECK ONLY ONE:

Have accepted delivery of this aircraft on

(date) out of state at

(city and state)

and have no knowledge or reason to believe that this aircraft will be domiciled in the state of Tennessee.

§ 67-6-313(h)(1) and the aircraft/

Will remove the aircraft/helicopter from Tennessee within fifteen (15) days of the date of purchase to TCA

helicopter will be domiciled in

(city and state)

Will remove the helicopter and related equipment within fifteen (15) days of repair completion.

Under the penalties of perjury, I (we) swear that the foregoing information is true and correct to the best of my (our) knowledge, information and

belief and this document correctly states the total amount of consideration for the transfer of this aircraft. I(We) understand that failure to report

proper consideration for the sale or transfer of the aforementioned aircraft may result in assessment of applicable sales tax, penalty and interest.

Date

Seller or Transferor’s Signature(s)

Purchaser or Transferee’s Signature(s)

Date

DEPARTMENT-WHITE COPY

SELLER-YELLOW COPY

PURCHASER-PINK COPY

INTERNET (9-04)

RV-F1403901 (Rev. 6-04)

1

1 2

2