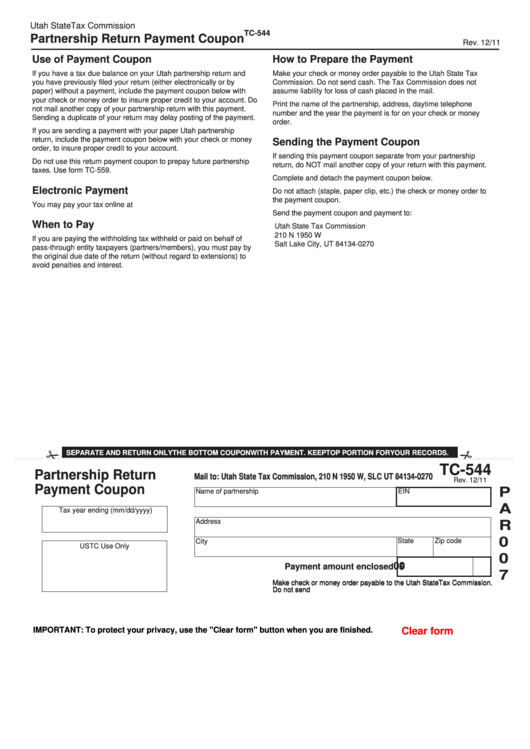

Utah State Tax Commission

TC-544

Partnership Return Payment Coupon

Rev. 12/11

Use of Payment Coupon

How to Prepare the Payment

If you have a tax due balance on your Utah partnership return and

Make your check or money order payable to the Utah State Tax

you have previously filed your return (either electronically or by

Commission. Do not send cash. The Tax Commission does not

paper) without a payment, include the payment coupon below with

assume liability for loss of cash placed in the mail.

your check or money order to insure proper credit to your account. Do

Print the name of the partnership, address, daytime telephone

not mail another copy of your partnership return with this payment.

number and the year the payment is for on your check or money

Sending a duplicate of your return may delay posting of the payment.

order.

If you are sending a payment with your paper Utah partnership

return, include the payment coupon below with your check or money

Sending the Payment Coupon

order, to insure proper credit to your account.

If sending this payment coupon separate from your partnership

Do not use this return payment coupon to prepay future partnership

return, do NOT mail another copy of your return with this payment.

taxes. Use form TC-559.

Complete and detach the payment coupon below.

Electronic Payment

Do not attach (staple, paper clip, etc.) the check or money order to

the payment coupon.

You may pay your tax online at taxexpress.utah.gov.

Send the payment coupon and payment to:

When to Pay

Utah State Tax Commission

210 N 1950 W

If you are paying the withholding tax withheld or paid on behalf of

Salt Lake City, UT 84134-0270

pass-through entity taxpayers (partners/members), you must pay by

the original due date of the return (without regard to extensions) to

avoid penalties and interest.

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS.

TC-544

Partnership Return

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0270

Rev. 12/11

Payment Coupon

P

Name of partnership

EIN

A

Tax year ending (mm/dd/yyyy)

Address

R

0

State

Zip code

City

USTC Use Only

0

00

$

Payment amount enclosed

7

Make check or money order payable to the Utah State Tax Commission.

Make check or money order payable to the Utah State Tax Commission.

Do not send cash. Do not staple check to coupon. Detach check stub.

Do not send cash. Do not staple check to coupon. Detach check stub.

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

1

1