Utah State Tax Commission

TC-559

Clear form

Print Form

Corporate/Partnership Payment Coupon

Rev. 12/11

Payment Coupon

Penalties and Interest

Use payment coupon TC-559 to make the following corporate/partnership

If your tax payments do not equal the lesser of 90% of the current year tax

tax payments:

liability ($100 minimum tax for corporations) or 100% of the previous year

tax liability, we will assess a penalty of 2% of the unpaid tax for each month

1) Estimated tax payments

of the extension period. We will assess a late filing penalty if you file the

2) Extension payments

return after the extension due date.

3) Return payments

We will assess interest at the legal rate from the original due date until paid

Mark the circle on the coupon that shows the type of payment you are making.

in full.

See Pub 58, Utah Interest and Penalties, online at tax.utah.gov/forms.

Corporation Estimated Tax Requirements

Where to File

Every corporation with a tax liability of $3,000 or more in the current or

previous tax year must make quarterly estimated tax payments. A parent

Send your payment coupon and payment to :

company filing a combined report must make the payment when the total

Corporate/Partnership Tax Payment

tax is $3,000 or more for all affiliated companies, including those that pay

Utah State Tax Commission

only the minimum tax.

210 N 1950 W

A corporation does not have to make estimated tax payments the first year

Salt Lake City, UT 84134-0180

it is required to file a Utah return if it makes a payment on or before the due

date, without extension, equal to or greater than the minimum tax.

Electronic Payment

Estimated tax payments are due in four equal payments on the 15th day of

You may pay your estimated tax payments, extension payments and return

the 4th, 6th, 9th and 12th months of the entity’s taxable year. You may

payments online at taxexpress.utah.gov.

make quarterly payments equal to 90% of the current year tax or 100% of

the previous year tax. A corporation that had a tax liability of $100 (the

minimum tax) for the previous year may prepay the minimum tax amount of

$100 on the 15th day of the 12th month instead of making four $25

payments.

The Tax Commission will charge an underpayment penalty to entities that

fail to make or underpay the required estimated tax.

Extension Payment Requirements

A corporation/partnership will have an automatic filing extension if it makes

the necessary extension payment by the return due date. The estimated

tax payments must equal at least the lesser of:

1) 90 percent of the current year tax liability

(or the $100 corporation minimum tax, if greater), or

2) 100 percent of the previous-year tax liability.

The remaining tax, plus any penalty and interest, is due when the return is filed.

Note: A pass-through entity (partnership or S corporation) must pay 100%

of any pass-through withholding by the original due date to avoid penalties

and interest.

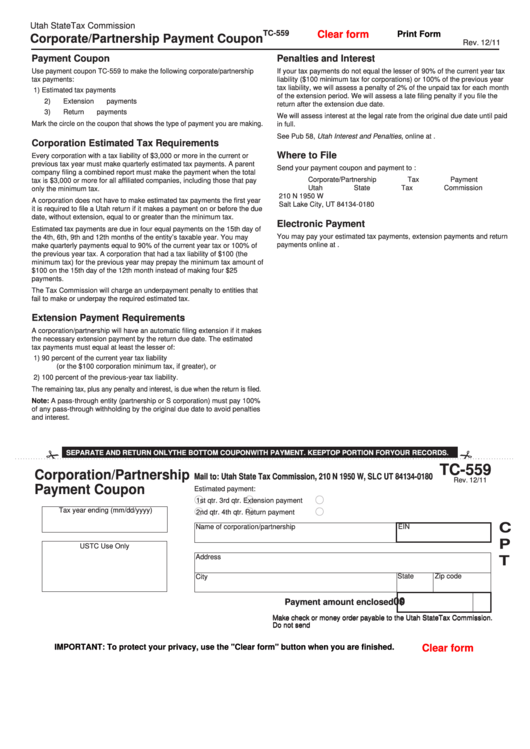

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS.

TC-559

Corporation/Partnership

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0180

Rev. 12/11

Payment Coupon

Estimated payment:

1st qtr.

3rd qtr.

Extension payment

Tax year ending (mm/dd/yyyy)

2nd qtr.

4th qtr.

Return payment

C

EIN

Name of corporation/partnership

P

USTC Use Only

Address

T

State

Zip code

City

00

$

Payment amount enclosed

Make check or money order payable to the Utah State Tax Commission.

Make check or money order payable to the Utah State Tax Commission.

Do not send cash. Do not staple check to coupon. Detach check stub.

Do not send cash. Do not staple check to coupon. Detach check stub.

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

1

1