Maine Annualized Income Installment Worksheet For Underpayment Of Estimated Tax Corporations And Financial Institutions - 2015

ADVERTISEMENT

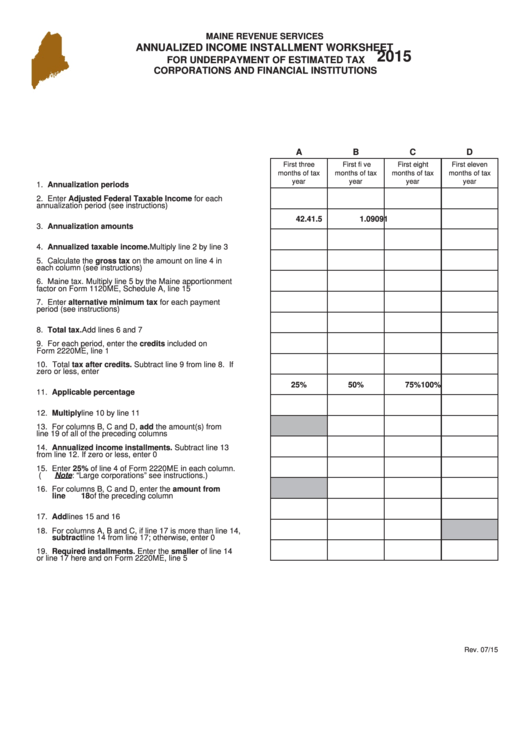

MAINE REVENUE SERVICES

ANNUALIZED INCOME INSTALLMENT WORKSHEET

2015

FOR UNDERPAYMENT OF ESTIMATED TAX

CORPORATIONS AND FINANCIAL INSTITUTIONS

A

B

C

D

First three

First fi ve

First eight

First eleven

months of tax

months of tax

months of tax

months of tax

year

year

year

year

1.

Annualization periods .........................................................1.

2.

Enter Adjusted Federal Taxable Income for each

annualization period (see instructions) .................................. 2.

4

2.4

1.5

1.09091

3.

Annualization amounts .......................................................3.

4.

Annualized taxable income. Multiply line 2 by line 3 ..........4.

5.

Calculate the gross tax on the amount on line 4 in

each column (see instructions)..............................................5.

6.

Maine tax. Multiply line 5 by the Maine apportionment

factor on Form 1120ME, Schedule A, line 15 ........................6.

7.

Enter alternative minimum tax for each payment

period (see instructions) ........................................................7.

8.

Total tax. Add lines 6 and 7 ..................................................8.

9.

For each period, enter the credits included on

Form 2220ME, line 1 .............................................................9.

10. Total tax after credits. Subtract line 9 from line 8. If

zero or less, enter 0.............................................................10.

25%

50%

75%

100%

11. Applicable percentage ...................................................... 11.

12. Multiply line 10 by line 11 ...................................................12.

13. For columns B, C and D, add the amount(s) from

line 19 of all of the preceding columns ................................13.

14. Annualized income installments. Subtract line 13

from line 12. If zero or less, enter 0 .....................................14.

15. Enter 25% of line 4 of Form 2220ME in each column.

(Note: “Large corporations” see instructions.).....................15.

16. For columns B, C and D, enter the amount from

line 18 of the preceding column ..........................................16.

17. Add lines 15 and 16 ............................................................17.

18. For columns A, B and C, if line 17 is more than line 14,

subtract line 14 from line 17; otherwise, enter 0 ................18.

19. Required installments. Enter the smaller of line 14

or line 17 here and on Form 2220ME, line 5 .......................19.

Rev. 07/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2