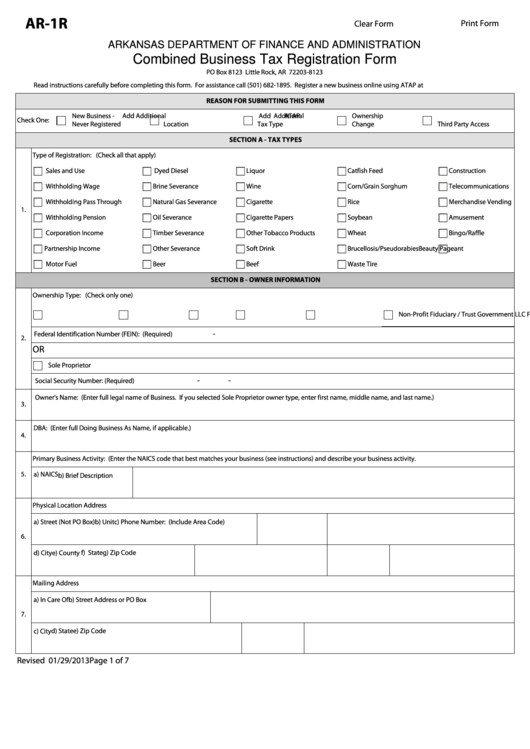

AR-1R

Clear Form

Print Form

ARKANSAS DEPARTMENT OF FINANCE AND ADMINISTRATION

Combined Business Tax Registration Form

PO Box 8123 Little Rock, AR 72203-8123

Read instructions carefully before completing this form. For assistance call (501) 682-1895. Register a new business online using ATAP at

REASON FOR SUBMITTING THIS FORM

New Business -

Add Additional

Add Additional

Ownership

ATAP

Check One:

Never Registered

Location

Tax Type

Change

Third Party Access

SECTION A - TAX TYPES

Type of Registration: (Check all that apply)

Sales and Use

Dyed Diesel

Liquor

Catfish Feed

Construction

Withholding Wage

Brine Severance

Wine

Corn/Grain Sorghum

Telecommunications

Withholding Pass Through

Natural Gas Severance

Cigarette

Rice

Merchandise Vending

1.

Withholding Pension

Oil Severance

Cigarette Papers

Soybean

Amusement

Corporation Income

Timber Severance

Other Tobacco Products

Wheat

Bingo/Raffle

Partnership Income

Other Severance

Soft Drink

Brucellosis/Pseudorabies

Beauty Pageant

Motor Fuel

Beer

Beef

Waste Tire

SECTION B - OWNER INFORMATION

Ownership Type: (Check only one)

Corporation

Partnership

LLC

Government

Fiduciary / Trust

Non-Profit

-

Federal Identification Number (FEIN): (Required)

2.

OR

Sole Proprietor

-

-

Social Security Number: (Required)

Owner's Name: (Enter full legal name of Business. If you selected Sole Proprietor owner type, enter first name, middle name, and last name.)

3.

DBA: (Enter full Doing Business As Name, if applicable.)

4.

Primary Business Activity: (Enter the NAICS code that best matches your business (see instructions) and describe your business activity.

5.

a) NAICS

b) Brief Description

Physical Location Address

a) Street (Not PO Box)

b) Unit

c) Phone Number: (Include Area Code)

6.

f) State

g) Zip Code

d) City

e) County

Mailing Address

a) In Care Of

b) Street Address or PO Box

7.

d) State

e) Zip Code

c) City

Revised 01/29/2013

Page 1 of 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7