Instructions For Delaware Form 300-I - 2012

ADVERTISEMENT

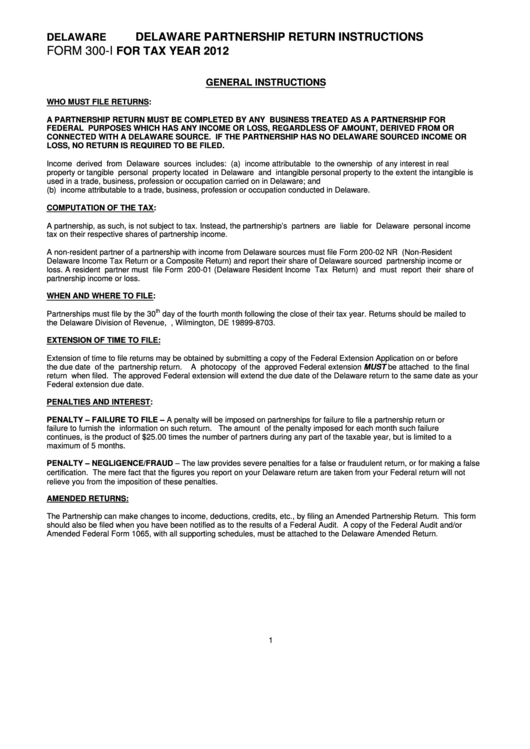

DELAWARE PARTNERSHIP RETURN INSTRUCTIONS

DELAWARE

FORM 300-I

FOR TAX YEAR 2012

GENERAL INSTRUCTIONS

WHO MUST FILE RETURNS:

A PARTNERSHIP RETURN MUST BE COMPLETED BY ANY BUSINESS TREATED AS A PARTNERSHIP FOR

FEDERAL PURPOSES WHICH HAS ANY INCOME OR LOSS, REGARDLESS OF AMOUNT, DERIVED FROM OR

CONNECTED WITH A DELAWARE SOURCE. IF THE PARTNERSHIP HAS NO DELAWARE SOURCED INCOME OR

LOSS, NO RETURN IS REQUIRED TO BE FILED.

Income derived from Delaware sources includes: (a) income attributable to the ownership of any interest in real

property or tangible personal property located in Delaware and intangible personal property to the extent the intangible is

used in a trade, business, profession or occupation carried on in Delaware; and

(b) income attributable to a trade, business, profession or occupation conducted in Delaware.

COMPUTATION OF THE TAX:

A partnership, as such, is not subject to tax. Instead, the partnership’s partners are liable for Delaware personal income

tax on their respective shares of partnership income.

A non-resident partner of a partnership with income from Delaware sources must file Form 200-02 NR (Non-Resident

Delaware Income Tax Return or a Composite Return) and report their share of Delaware sourced partnership income or

loss. A resident partner must file Form 200-01 (Delaware Resident Income Tax Return) and must report their share of

partnership income or loss.

WHEN AND WHERE TO FILE:

th

Partnerships must file by the 30

day of the fourth month following the close of their tax year. Returns should be mailed to

the Delaware Division of Revenue, P.O. Box 8703, Wilmington, DE 19899-8703.

EXTENSION OF TIME TO FILE:

Extension of time to file returns may be obtained by submitting a copy of the Federal Extension Application on or before

the due date of the partnership return.

A photocopy of the approved Federal extension MUST be attached to the final

return when filed. The approved Federal extension will extend the due date of the Delaware return to the same date as your

Federal extension due date.

PENALTIES AND INTEREST:

PENALTY – FAILURE TO FILE – A penalty will be imposed on partnerships for failure to file a partnership return or

failure to furnish the information on such return.

The amount of the penalty imposed for each month such failure

continues, is the product of $25.00 times the number of partners during any part of the taxable year, but is limited to a

maximum of 5 months.

PENALTY – NEGLIGENCE/FRAUD – The law provides severe penalties for a false or fraudulent return, or for making a false

certification. The mere fact that the figures you report on your Delaware return are taken from your Federal return will not

relieve you from the imposition of these penalties.

AMENDED RETURNS:

The Partnership can make changes to income, deductions, credits, etc., by filing an Amended Partnership Return. This form

should also be filed when you have been notified as to the results of a Federal Audit. A copy of the Federal Audit and/or

Amended Federal Form 1065, with all supporting schedules, must be attached to the Delaware Amended Return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4