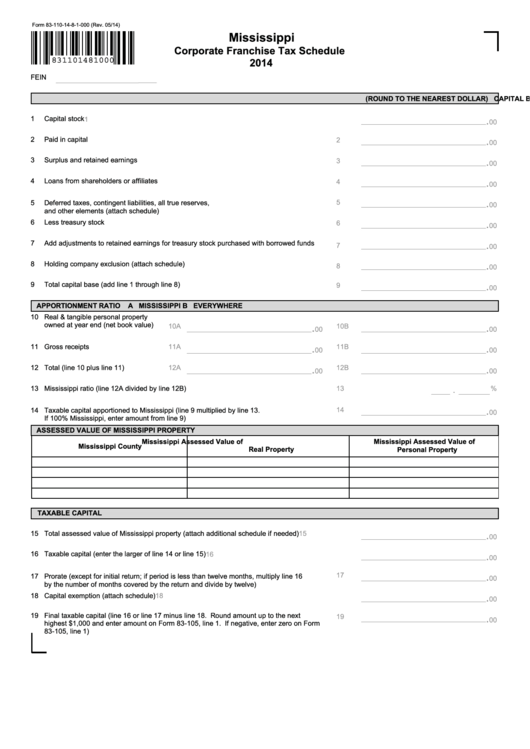

Form 83-110-14-8-1-000 (Rev. 05/14)

Mississippi

Corporate Franchise Tax Schedule

831101481000

2014

FEIN

CAPITAL BASE

(ROUND TO THE NEAREST DOLLAR)

.

1

Capital stock

1

00

.

2

Paid in capital

2

00

.

3

Surplus and retained earnings

3

00

.

4

Loans from shareholders or affiliates

4

00

.

5

5

Deferred taxes, contingent liabilities, all true reserves,

00

and other elements (attach schedule)

.

6

Less treasury stock

6

00

.

7

Add adjustments to retained earnings for treasury stock purchased with borrowed funds

7

00

.

8

Holding company exclusion (attach schedule)

8

00

.

9

Total capital base (add line 1 through line 8)

9

00

APPORTIONMENT RATIO

A MISSISSIPPI

B EVERYWHERE

10 Real & tangible personal property

owned at year end (net book value)

.

.

10A

10B

00

00

.

.

11 Gross receipts

11A

11B

00

00

.

.

12 Total (line 10 plus line 11)

12A

12B

00

00

13 Mississippi ratio (line 12A divided by line 12B)

13

.

%

.

14

14 Taxable capital apportioned to Mississippi (line 9 multiplied by line 13.

00

If 100% Mississippi, enter amount from line 9)

ASSESSED VALUE OF MISSISSIPPI PROPERTY

Mississippi Assessed Value of

Mississippi Assessed Value of

Mississippi County

Real Property

Personal Property

TAXABLE CAPITAL

.

15 Total assessed value of Mississippi property (attach additional schedule if needed)

15

00

16 Taxable capital (enter the larger of line 14 or line 15)

.

16

00

.

17

17 Prorate (except for initial return; if period is less than twelve months, multiply line 16

00

by the number of months covered by the return and divide by twelve)

.

18 Capital exemption (attach schedule)

18

00

19 Final taxable capital (line 16 or line 17 minus line 18. Round amount up to the next

.

19

00

highest $1,000 and enter amount on Form 83-105, line 1. If negative, enter zero on Form

83-105, line 1)

1

1