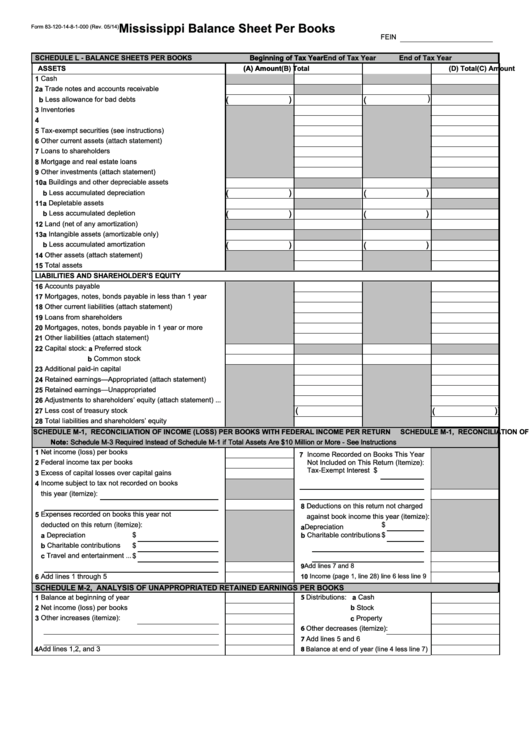

Mississippi Balance Sheet Per Books

Form 83-120-14-8-1-000 (Rev. 05/14)

FEIN

SCHEDULE L - BALANCE SHEETS PER BOOKS

Beginning of Tax Year

Beginning of Tax Year

End of Tax Year

End of Tax Year

ASSETS

(A) Amount

(A) Amount

(B) Total

(C) Amount

(D) Total

1 Cash ....................................................................................

2a Trade notes and accounts receivable ...............................

)

)

)

(

(

b Less allowance for bad debts ...........................................

(

(

3 Inventories ..........................................................................

4 U.S. government obligations ...............................................

5 Tax-exempt securities (see instructions) ............................

6 Other current assets (attach statement) .............................

7 Loans to shareholders ........................................................

8 Mortgage and real estate loans ..........................................

9 Other investments (attach statement) ................................

10a Buildings and other depreciable assets ..........................

)

)

)

)

b Less accumulated depreciation ......................................

(

(

(

(

11a Depletable assets ...........................................................

b Less accumulated depletion ...........................................

(

(

)

)

(

(

)

)

12 Land (net of any amortization) ..........................................

13a Intangible assets (amortizable only) ...............................

)

)

)

)

b Less accumulated amortization ......................................

(

(

(

(

14 Other assets (attach statement) .......................................

15 Total assets ......................................................................

LIABILITIES AND SHAREHOLDER'S EQUITY

16 Accounts payable .............................................................

17 Mortgages, notes, bonds payable in less than 1 year ......

18 Other current liabilities (attach statement) ........................

19 Loans from shareholders ..................................................

20 Mortgages, notes, bonds payable in 1 year or more ........

21 Other liabilities (attach statement) ....................................

22 Capital stock: a Preferred stock ........................................

b Common stock .......................................

23 Additional paid-in capital ...................................................

24 Retained earnings—Appropriated (attach statement) ......

25 Retained earnings—Unappropriated ................................

26 Adjustments to shareholders’ equity (attach statement) ...

(

(

)

)

)

)

27 Less cost of treasury stock ...............................................

(

(

28 Total liabilities and shareholders’ equity ...........................

SCHEDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN

SCHEDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN

Note: Schedule M-3 Required Instead of Schedule M-1 if Total Assets Are $10 Million or More - See Instructions

Note: Schedule M-3 Required Instead of Schedule M-1 if Total Assets Are $10 Million or More - See Instructions

1 Net income (loss) per books ...............................................

7 Income Recorded on Books This Year

2 Federal income tax per books ............................................

Not Included on This Return (Itemize):

Tax-Exempt Interest $

3 Excess of capital losses over capital gains .........................

4 Income subject to tax not recorded on books .....................

this year (itemize):

8 Deductions on this return not charged

5 Expenses recorded on books this year not ........................

against book income this year (itemize):

deducted on this return (itemize):

$

a Depreciation ..................

a Depreciation .......................

$

b Charitable contributions

$

b Charitable contributions .....

$

c Travel and entertainment ...

$

9 Add lines 7 and 8 .....................................

6 Add lines 1 through 5 ..........................................................

10 Income (page 1, line 28) line 6 less line 9

SCHEDULE M-2, ANALYSIS OF UNAPPROPRIATED RETAINED EARNINGS PER BOOKS

5 Distributions: a Cash ..........................

1 Balance at beginning of year ..............................................

2 Net income (loss) per books ...............................................

b Stock .........................

3 Other increases (itemize):

c Property .....................

6 Other decreases (itemize):

7 Add lines 5 and 6 .................................

8 Balance at end of year (line 4 less line 7)

4 Add lines 1,2, and 3 ............................................................

1

1