Form Ct-3-A/att - Schedules A, B, And C - Attachment To Form Ct-3-A - 2013

ADVERTISEMENT

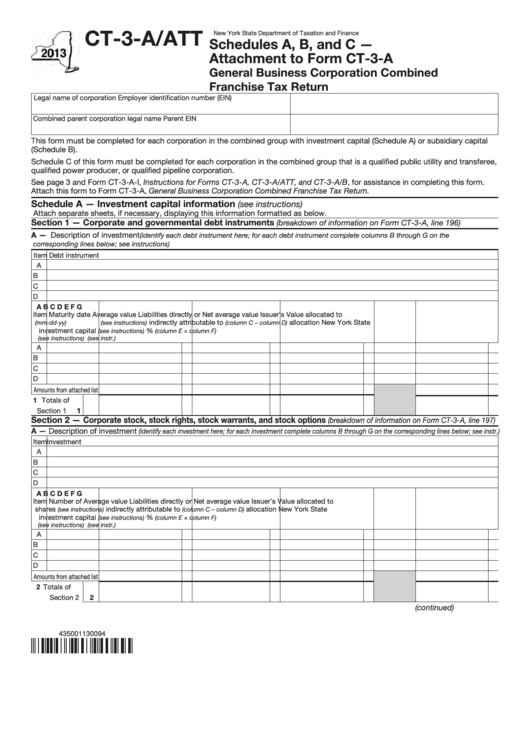

CT-3-A/ATT

New York State Department of Taxation and Finance

Schedules A, B, and C —

Attachment to Form CT-3-A

General Business Corporation Combined

Franchise Tax Return

Legal name of corporation

Employer identification number (EIN)

Combined parent corporation legal name

Parent EIN

This form must be completed for each corporation in the combined group with investment capital (Schedule A) or subsidiary capital

(Schedule B).

Schedule C of this form must be completed for each corporation in the combined group that is a qualified public utility and transferee,

qualified power producer, or qualified pipeline corporation.

See page 3 and Form CT-3-A-I, Instructions for Forms CT-3-A, CT-3-A/ATT, and CT-3-A/B, for assistance in completing this form.

Attach this form to Form CT-3-A, General Business Corporation Combined Franchise Tax Return.

Schedule A — Investment capital information

(see instructions)

Attach separate sheets, if necessary, displaying this information formatted as below.

Section 1 — Corporate and governmental debt instruments

(breakdown of information on Form CT-3-A, line 196)

A — Description of investment

(identify each debt instrument here; for each debt instrument complete columns B through G on the

corresponding lines below; see instructions)

Item

Debt instrument

A

B

C

D

A

B

C

D

E

F

G

Item Maturity date

Average value

Liabilities directly or

Net average value

Issuer’s

Value allocated to

indirectly attributable to

allocation

New York State

(mm-dd-yy)

(see instructions)

(column C – column D)

investment capital

%

(see instructions)

(column E × column F)

(see instructions)

(see instr.)

A

B

C

D

Amounts from attached list

1 Totals of

1

Section 1

Section 2 — Corporate stock, stock rights, stock warrants, and stock options

(breakdown of information on Form CT-3-A, line 197)

A — Description of investment

(identify each investment here; for each investment complete columns B through G on the corresponding lines below; see instr.)

Item

Investment

A

B

C

D

A

B

C

D

E

F

G

Item

Number of

Average value

Liabilities directly or

Net average value

Issuer’s

Value allocated to

shares

indirectly attributable to

allocation

New York State

(see instructions)

(column C – column D)

investment capital

%

(see instructions)

(column E × column F)

(see instructions)

(see instr.)

A

B

C

D

Amounts from attached list

2 Totals of

Section 2

2

(continued)

435001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3