Instructions For Form Ar-1rarkansas Combined Business Registration Form

ADVERTISEMENT

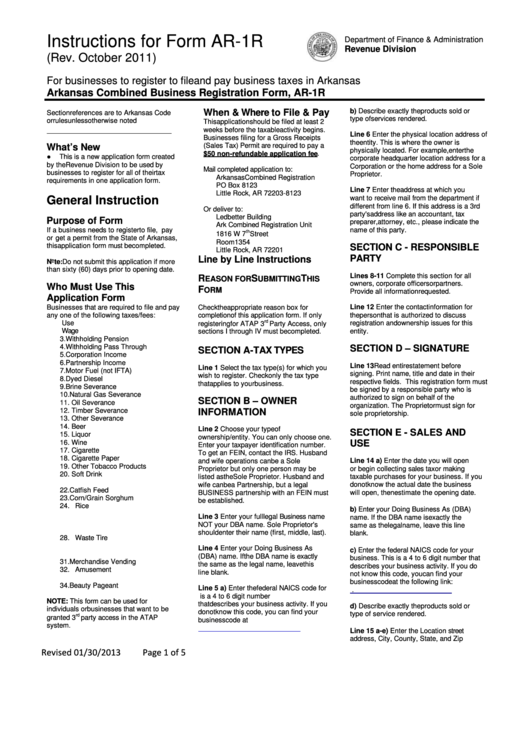

Instructions for Form AR-1R

Department of Finance & Administration

Revenue Division

(Rev. October 2011)

For businesses to register to file and pay business taxes in Arkansas

Arkansas Combined Business Registration Form, AR-1R

b) Describe exactly the products sold or

When & Where to File & Pay

Section references are to Arkansas Code

type of services rendered.

or rules unless otherwise noted

This application should be filed at least 2

weeks before the taxable activity begins.

Line 6 Enter the physical location address of

Businesses filing for a Gross Receipts

the entity. This is where the owner is

(Sales Tax) Permit are required to pay a

What’s New

physically located. For example, enter the

$50 non-refundable application fee .

●

This is a new application form created

corporate headquarter location address for a

by the Revenue Division to be used by

Corporation or the home address for a Sole

Mail completed application to:

businesses to register for all of their tax

Proprietor.

Arkansas Combined Registration

requirements in one application form.

PO Box 8123

Line 7 Enter the address at which you

Little Rock, AR 72203-8123

want to receive mail from the department if

General Instruction

different from line 6. If this address is a 3rd

Or deliver to:

party's address like an accountant, tax

Ledbetter Building

Purpose of Form

preparer, attorney, etc., please indicate the

Ark Combined Registration Unit

If a business needs to register to file, pay

name of this party.

th

1816 W 7

Street

or get a permit from the State of Arkansas,

Room 1354

this application form must be completed.

SECTION C - RESPONSIBLE

Little Rock, AR 72201

PARTY

Line by Line Instructions

Note: Do not submit this application if more

than sixty (60) days prior to opening date.

Lines 8-11 Complete this section for all

R

S

T

EASON FOR

UBMITTING

HIS

owners, corporate officers or partners.

Who Must Use This

F

ORM

Provide all information requested.

Application Form

Businesses that are required to file and pay

Line 12 Enter the contact information for

Check the appropriate reason box for

any one of the following taxes/fees:

completion of this application form. If only

the person that is authorized to discuss

rd

1.

Sales and Use

registration and ownership issues for this

registering for ATAP 3

Party Access, only

2.

Withholding Wage

sections I through IV must be completed.

entity.

3.

Withholding Pension

4.

Withholding Pass Through

SECTION D – SIGNATURE

SECTION A-TAX TYPES

5.

Corporation Income

6.

Partnership Income

Line 13 Read entire statement before

Line 1 Select the tax type(s) for which you

7.

Motor Fuel (not IFTA)

signing. Print name, title and date in their

wish to register. Check only the tax type

8.

Dyed Diesel

respective fields. This registration form must

that applies to your business.

9.

Brine Severance

be signed by a responsible party who is

10. Natural Gas Severance

authorized to sign on behalf of the

SECTION B – OWNER

11. Oil Severance

organization. The Proprietor must sign for

12. Timber Severance

INFORMATION

sole proprietorship.

13. Other Severance

14. Beer

Line 2 Choose your type of

SECTION E - SALES AND

15. Liquor

ownership/entity. You can only choose one.

16. Wine

USE

Enter your taxpayer identification number.

17. Cigarette

To get an FEIN, contact the IRS. Husband

18. Cigarette Paper

Line 14 a) Enter the date you will open

and wife operations can be a Sole

19. Other Tobacco Products

or begin collecting sales tax or making

Proprietor but only one person may be

20. Soft Drink

taxable purchases for your business. If you

listed as the Sole Proprietor. Husband and

21. Beef

wife can be a Partnership, but a legal

do not know the actual date the business

22. Catfish Feed

BUSINESS partnership with an FEIN must

will open, then estimate the opening date.

23. Corn/Grain Sorghum

be established.

24. Rice

b) Enter your Doing Business As (DBA)

25. Soybean

Line 3 Enter your full legal Business name

name. If the DBA name is exactly the

26. Wheat

NOT your DBA name. Sole Proprietor's

same as the legal name, leave this line

27. Brucellosis/Pseudorabies

should enter their name (first, middle, last).

blank.

28. Waste Tire

29. Construction

Line 4 Enter your Doing Business As

c) Enter the federal NAICS code for your

30. Telecommunications

(DBA) name. If the DBA name is exactly

business. This is a 4 to 6 digit number that

31. Merchandise Vending

the same as the legal name, leave this

describes your business activity. If you do

32. Amusement

line blank.

not know this code, you can find your

33. Bingo/Raffle

business code at the following link:

34. Beauty Pageant

Line 5 a) Enter the federal NAICS code for

.

your business. This is a 4 to 6 digit number

NOTE: This form can be used for

that describes your business activity. If you

d) Describe exactly the products sold or

individuals or businesses that want to be

do not know this code, you can find your

type of service rendered.

rd

granted 3

party access in the ATAP

business code at

system.

Line 15 a-e) Enter the Location street

address, City, County, State, and Zip

Revised 01/30/2013

Page 1 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5