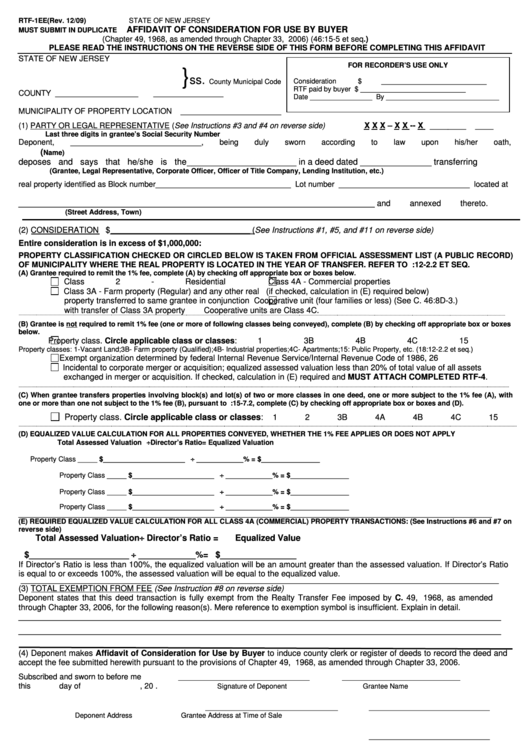

RTF-1EE (Rev. 12/09)

STATE OF NEW JERSEY

AFFIDAVIT OF CONSIDERATION FOR USE BY BUYER

MUST SUBMIT IN DUPLICATE

(Chapter 49, P.L.1968, as amended through Chapter 33, P.L. 2006) (N.J.S.A. 46:15-5 et seq.)

PLEASE READ THE INSTRUCTIONS ON THE REVERSE SIDE OF THIS FORM BEFORE COMPLETING THIS AFFIDAVIT

STATE OF NEW JERSEY

FOR RECORDER’S USE ONLY

}

ss.

Consideration

$ ___________________________

County Municipal Code

RTF paid by buyer

$ ___________________________

COUNTY

___________________

________________

Date ________________ By _____________________________

MUNICIPALITY OF PROPERTY LOCATION _______________________

(1) PARTY OR LEGAL REPRESENTATIVE (See Instructions #3 and #4 on reverse side)

X X X – X X -- X ____

____

____

Last three digits in grantee’s Social Security Number

Deponent,

______________________________,

being

duly

sworn

according

to

law

upon

his/her

oath,

(

Name)

deposes and says that he/she is the_______________________ in a deed dated _______________ transferring

(Grantee, Legal Representative, Corporate Officer, Officer of Title Company, Lending Institution, etc.)

real property identified as Block number _______________________________ Lot number ______________________________ located at

_______________________________________________________________________________

and

annexed

thereto.

(Street Address, Town)

(2) CONSIDERATION $_______________________________ (See Instructions #1, #5, and #11 on reverse side)

Entire consideration is in excess of $1,000,000:

PROPERTY CLASSIFICATION CHECKED OR CIRCLED BELOW IS TAKEN FROM OFFICIAL ASSESSMENT LIST (A PUBLIC RECORD)

OF MUNICIPALITY WHERE THE REAL PROPERTY IS LOCATED IN THE YEAR OF TRANSFER. REFER TO N.J.A.C. 18:12-2.2 ET SEQ.

(A) Grantee required to remit the 1% fee, complete (A) by checking off appropriate box or boxes below.

Class 2 - Residential

Class 4A - Commercial properties

Class 3A - Farm property (Regular) and any other real

(if checked, calculation in (E) required below)

property transferred to same grantee in conjunction

Cooperative unit (four families or less) (See C. 46:8D-3.)

with transfer of Class 3A property

Cooperative units are Class 4C.

(B) Grantee is not required to remit 1% fee (one or more of following classes being conveyed), complete (B) by checking off appropriate box or boxes

below.

Property class. Circle applicable class or classes:

1

3B

4B

4C

15

Property classes: 1-Vacant Land;3B- Farm property (Qualified);4B- Industrial properties;4C- Apartments;15: Public Property, etc. (N.J.A.C. 18:12-2.2 et seq.)

Exempt organization determined by federal Internal Revenue Service/Internal Revenue Code of 1986, 26 U.S.C. s. 501.

Incidental to corporate merger or acquisition; equalized assessed valuation less than 20% of total value of all assets

exchanged in merger or acquisition. If checked, calculation in (E) required and MUST ATTACH COMPLETED RTF-4.

(C) When grantee transfers properties involving block(s) and lot(s) of two or more classes in one deed, one or more subject to the 1% fee (A), with

one or more than one not subject to the 1% fee (B), pursuant to N.J.S.A. 46:15-7.2, complete (C) by checking off appropriate box or boxes and (D).

Property class. Circle applicable class or classes:

1

2

3B

4A

4B

4C

15

(D) EQUALIZED VALUE CALCULATION FOR ALL PROPERTIES CONVEYED, WHETHER THE 1% FEE APPLIES OR DOES NOT APPLY

Total Assessed Valuation Director’s Ratio = Equalized Valuation

$_____________________ ____________% = $_______________

Property Class _____

$_____________________ ____________% = $_______________

Property Class _____

$_____________________ ____________% = $_______________

Property Class _____

$_____________________ ____________% = $_______________

Property Class _____

_________________________________________________________________________________________________________

(E) REQUIRED EQUALIZED VALUE CALCULATION FOR ALL CLASS 4A (COMMERCIAL) PROPERTY TRANSACTIONS: (See Instructions #6 and #7 on

reverse side)

Total Assessed Valuation Director’s Ratio =

Equalized Value

$_____________________ ____________% = $________________

If Director’s Ratio is less than 100%, the equalized valuation will be an amount greater than the assessed valuation. If Director’s Ratio

is equal to or exceeds 100%, the assessed valuation will be equal to the equalized value.

__________________________________________________________________________________________________________

(3) TOTAL EXEMPTION FROM FEE (See Instruction #8 on reverse side)

Deponent states that this deed transaction is fully exempt from the Realty Transfer Fee imposed by C. 49, P.L. 1968, as amended

through Chapter 33, P.L. 2006, for the following reason(s). Mere reference to exemption symbol is insufficient. Explain in detail.

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

(4) Deponent makes Affidavit of Consideration for Use by Buyer to induce county clerk or register of deeds to record the deed and

accept the fee submitted herewith pursuant to the provisions of Chapter 49, P.L. 1968, as amended through Chapter 33, P.L. 2006.

Subscribed and sworn to before me

______________________________

___________________________

this

day of

, 20

.

Signature of Deponent

Grantee Name

__________________________________

_______________________________

Deponent Address

Grantee Address at Time of Sale

_______________________________

Name/Company of Settlement Officer

County recording officers: forward one copy of each RTF-1EE to:

FOR OFFICIAL USE ONLY

STATE OF NJ - DIVISION OF TAXATION

Instrument Number_________ County______________

PO BOX 251

Deed Number____________Book ______ Page ______

Deed Dated _________

Date Recorded _________

TRENTON, NJ 08695-0251

ATTENTION: REALTY TRANSFER FEE UNIT

The Director, Division of Taxation, Department of the Treasury has prescribed this form, as required by law. It may not be altered or amended without prior

approval of the Director. For further information on the Realty Transfer Fee or to print a copy of this Affidavit or any other relevant forms, visit:

1

1 2

2