Form Rv-F1320101 - Tennessee Sales Or Use Tax Certificate Of Exemption

ADVERTISEMENT

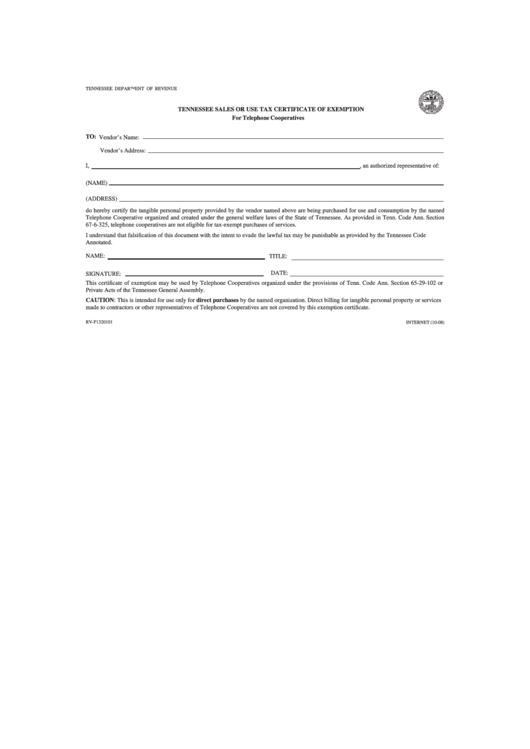

TENNESSEE DEPARTMENT OF REVENUE

TENNESSEE SALES OR USE TAX CERTIFICATE OF EXEMPTION

For Telephone Cooperatives

TO: Vendor’s Name:

Vendor’s Address:

I,

, an authorized representative of:

(NAME)

(ADDRESS)

do hereby certify the tangible personal property provided by the vendor named above are being purchased for use and consumption by the named

Telephone Cooperative organized and created under the general welfare laws of the State of Tennessee. As provided in Tenn. Code Ann. Section

67-6-325, telephone cooperatives are not eligible for tax-exempt purchases of services.

I understand that falsification of this document with the intent to evade the lawful tax may be punishable as provided by the Tennessee Code

Annotated.

NAME:

TITLE:

DATE:

SIGNATURE:

This certificate of exemption may be used by Telephone Cooperatives organized under the provisions of Tenn. Code Ann. Section 65-29-102 or

Private Acts of the Tennessee General Assembly.

CAUTION: This is intended for use only for direct purchases by the named organization. Direct billing for tangible personal property or services

made to contractors or other representatives of Telephone Cooperatives are not covered by this exemption certificate.

RV-F1320101

INTERNET (10-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1