Form Rv-F1319901 - Affidavit Of Exemption From Motor Oil Fee

ADVERTISEMENT

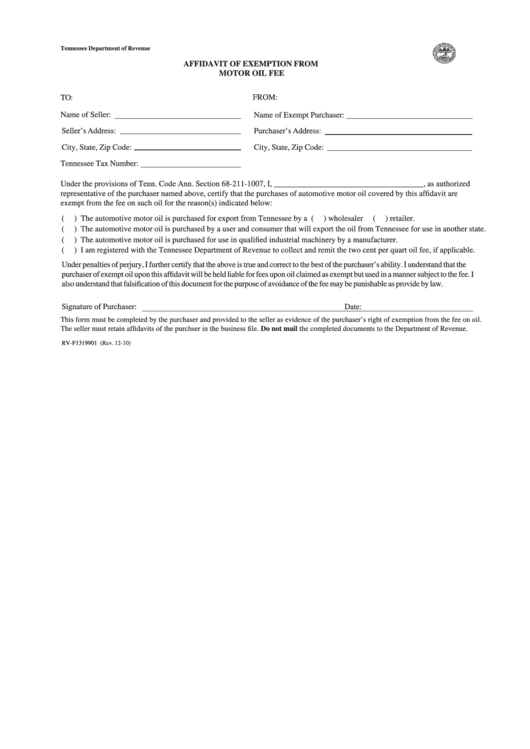

Tennessee Department of Revenue

AFFIDAVIT OF EXEMPTION FROM

MOTOR OIL FEE

FROM:

TO:

Name of Seller:

Name of Exempt Purchaser:

Seller’s Address:

Purchaser’s Address:

City, State, Zip Code:

City, State, Zip Code:

Tennessee Tax Number:

Under the provisions of Tenn. Code Ann. Section 68-211-1007, I, _____________________________________, as authorized

representative of the purchaser named above, certify that the purchases of automotive motor oil covered by this affidavit are

exempt from the fee on such oil for the reason(s) indicated below:

(

) The automotive motor oil is purchased for export from Tennessee by a (

) wholesaler

(

) retailer.

(

) The automotive motor oil is purchased by a user and consumer that will export the oil from Tennessee for use in another state.

(

) The automotive motor oil is purchased for use in qualified industrial machinery by a manufacturer.

(

) I am registered with the Tennessee Department of Revenue to collect and remit the two cent per quart oil fee, if applicable.

Under penalties of perjury, I further certify that the above is true and correct to the best of the purchaser’s ability. I understand that the

purchaser of exempt oil upon this affidavit will be held liable for fees upon oil claimed as exempt but used in a manner subject to the fee. I

also understand that falsification of this document for the purpose of avoidance of the fee may be punishable as provide by law.

Signature of Purchaser:

Date:

This form must be completed by the purchaser and provided to the seller as evidence of the purchaser’s right of exemption from the fee on oil.

The seller must retain affidavits of the purchser in the business file. Do not mail the completed documents to the Department of Revenue.

RV-F1319901

(Rev. 12-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1