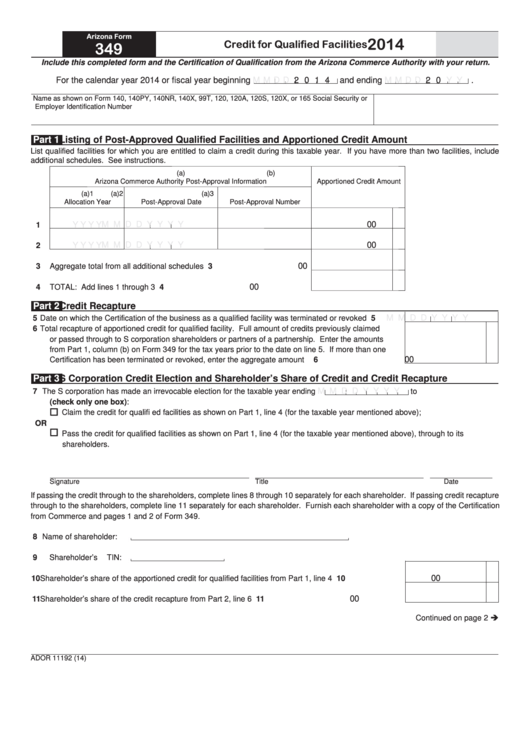

Arizona Form

2014

Credit for Qualified Facilities

349

Include this completed form and the Certification of Qualification from the Arizona Commerce Authority with your return.

For the calendar year 2014 or fiscal year beginning

2 0 1 4 and ending

.

M M D D

M M D D

2 0

Y Y

Name as shown on Form 140, 140PY, 140NR, 140X, 99T, 120, 120A, 120S, 120X, or 165

Social Security or

Employer Identification Number

Listing of Post-Approved Qualified Facilities and Apportioned Credit Amount

Part 1

List qualified facilities for which you are entitled to claim a credit during this taxable year. If you have more than two facilities, include

additional schedules. See instructions.

(a)

(b)

Arizona Commerce Authority Post-Approval Information

Apportioned Credit Amount

(a)1

(a)2

(a)3

Allocation Year

Post-Approval Date

Post-Approval Number

M M D D Y Y Y Y

00

1

Y Y Y Y

M M D D Y Y Y Y

Y Y Y Y

00

2

00

3

Aggregate total from all additional schedules ............................................ 3

00

4

TOTAL: Add lines 1 through 3 .................................................................. 4

Part 2

Credit Recapture

M M D D Y Y Y Y

5

Date on which the Certification of the business as a qualified facility was terminated or revoked ....

5

6

Total recapture of apportioned credit for qualified facility. Full amount of credits previously claimed

or passed through to S corporation shareholders or partners of a partnership. Enter the amounts

from Part 1, column (b) on Form 349 for the tax years prior to the date on line 5. If more than one

00

Certification has been terminated or revoked, enter the aggregate amount .....................................

6

Part 3

S Corporation Credit Election and Shareholder’s Share of Credit and Credit Recapture

M M D D Y Y Y Y

7

The S corporation has made an irrevocable election for the taxable year ending

to

(check only one box):

Claim the credit for qualifi ed facilities as shown on Part 1, line 4 (for the taxable year mentioned above);

OR

Pass the credit for qualified facilities as shown on Part 1, line 4 (for the taxable year mentioned above), through to its

shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 8 through 10 separately for each shareholder. If passing credit recapture

through to the shareholders, complete line 11 separately for each shareholder. Furnish each shareholder with a copy of the Certification

from Commerce and pages 1 and 2 of Form 349.

8

Name of shareholder:

9

Shareholder’s TIN:

00

10

Shareholder’s share of the apportioned credit for qualified facilities from Part 1, line 4 .................... 10

00

11

Shareholder’s share of the credit recapture from Part 2, line 6 ......................................................... 11

Continued on page 2

ADOR 11192 (14)

1

1 2

2