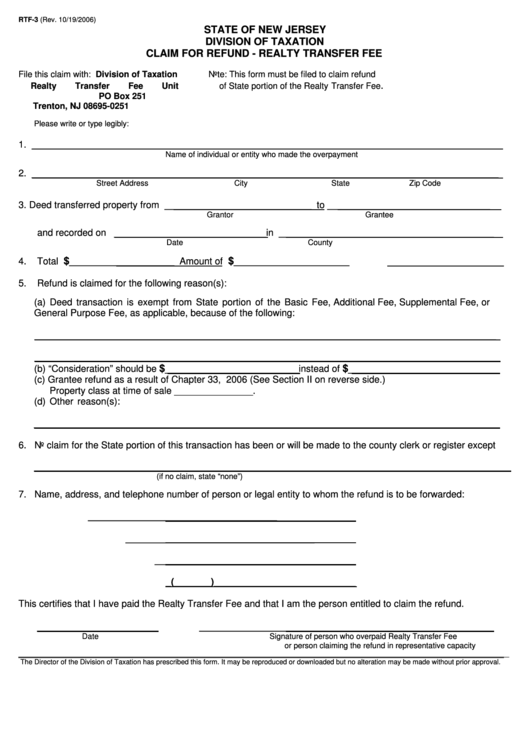

RTF-3 (Rev. 10/19/2006)

STATE OF NEW JERSEY

DIVISION OF TAXATION

CLAIM FOR REFUND - REALTY TRANSFER FEE

File this claim with:

Division of Taxation

Note: This form must be filed to claim refund

.

Realty Transfer Fee Unit

of State portion of the Realty Transfer Fee

PO Box 251

Trenton, NJ 08695-0251

Please write or type legibly:

1. _________________________________________________________________________________________

Name of individual or entity who made the overpayment

2. _________________________________________________________________________________________

Street Address

City

State

Zip Code

3.

Deed transferred property from ____________________________ to _______________________________

Grantor

Grantee

and recorded on _____________________________ in _________________________________________

Date

County

$

$

4.

Total R.T.F. paid

____________________ Amount of R.T.F. claimed for refund

______________________

5.

Refund is claimed for the following reason(s):

(a) Deed transaction is exempt from State portion of the Basic Fee, Additional Fee, Supplemental Fee, or

General Purpose Fee, as applicable, because of the following:

________________________________________________________________________________________

________________________________________________________________________________________

$

$

(b) “Consideration” should be

_________________________ instead of

____________________________

(c) Grantee refund as a result of Chapter 33, P.L. 2006 (See Section II on reverse side.)

Property class at time of sale _______________.

(d) Other reason(s):

________________________________________________________________________________________

6. No claim for the State portion of this transaction has been or will be made to the county clerk or register except

__________________________________________________________________________________________

(if no claim, state “none”)

7. Name, address, and telephone number of person or legal entity to whom the refund is to be forwarded:

____________________________________

____________________________________

____________________________________

_(_______)___________________________

This certifies that I have paid the Realty Transfer Fee and that I am the person entitled to claim the refund.

_____________________

____________________________________

Date

Signature of person who overpaid Realty Transfer Fee

or person claiming the refund in representative capacity

______________________________________________________________________________________________________________________________

The Director of the Division of Taxation has prescribed this form. It may be reproduced or downloaded but no alteration may be made without prior approval.

1

1 2

2