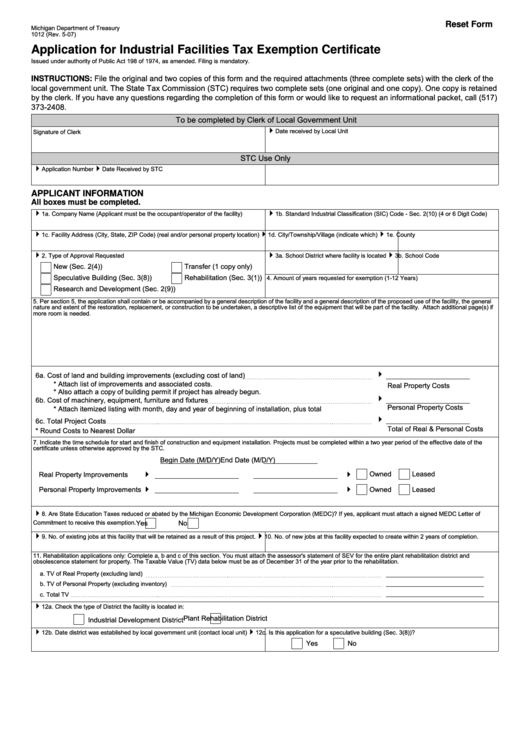

Reset Form

Michigan Department of Treasury

1012 (Rev. 5-07)

Application for Industrial Facilities Tax Exemption Certificate

Issued under authority of Public Act 198 of 1974, as amended. Filing is mandatory.

INSTRUCTIONS: File the original and two copies of this form and the required attachments (three complete sets) with the clerk of the

local government unit. The State Tax Commission (STC) requires two complete sets (one original and one copy). One copy is retained

by the clerk. If you have any questions regarding the completion of this form or would like to request an informational packet, call (517)

373-2408.

To be completed by Clerk of Local Government Unit

Date received by Local Unit

Signature of Clerk

STC Use Only

Application Number

Date Received by STC

APPLICANT INFORMATION

All boxes must be completed.

1a. Company Name (Applicant must be the occupant/operator of the facility)

1b. Standard Industrial Classification (SIC) Code - Sec. 2(10) (4 or 6 Digit Code)

1c. Facility Address (City, State, ZIP Code) (real and/or personal property location)

1d. City/Township/Village (indicate which)

1e. County

2. Type of Approval Requested

3a. School District where facility is located

3b. School Code

New (Sec. 2(4))

Transfer (1 copy only)

Speculative Building (Sec. 3(8))

Rehabilitation (Sec. 3(1))

4. Amount of years requested for exemption (1-12 Years)

Research and Development (Sec. 2(9))

5. Per section 5, the application shall contain or be accompanied by a general description of the facility and a general description of the proposed use of the facility, the general

nature and extent of the restoration, replacement, or construction to be undertaken, a descriptive list of the equipment that will be part of the facility. Attach additional page(s) if

more room is needed.

6a. Cost of land and building improvements (excluding cost of land)

* Attach list of improvements and associated costs.

Real Property Costs

* Also attach a copy of building permit if project has already begun.

6b. Cost of machinery, equipment, furniture and fixtures

Personal Property Costs

* Attach itemized listing with month, day and year of beginning of installation, plus total

6c. Total Project Costs

Total of Real & Personal Costs

* Round Costs to Nearest Dollar

7. Indicate the time schedule for start and finish of construction and equipment installation. Projects must be completed within a two year period of the effective date of the

certificate unless otherwise approved by the STC.

Begin Date (M/D/Y)

End Date (M/D/Y)

Owned

Leased

Real Property Improvements

Personal Property Improvements

Owned

Leased

8. Are State Education Taxes reduced or abated by the Michigan Economic Development Corporation (MEDC)? If yes, applicant must attach a signed MEDC Letter of

Commitment to receive this exemption.

Yes

No

9. No. of existing jobs at this facility that will be retained as a result of this project.

10. No. of new jobs at this facility expected to create within 2 years of completion.

11. Rehabilitation applications only: Complete a, b and c of this section. You must attach the assessor's statement of SEV for the entire plant rehabilitation district and

obsolescence statement for property. The Taxable Value (TV) data below must be as of December 31 of the year prior to the rehabilitation.

a. TV of Real Property (excluding land)

b. TV of Personal Property (excluding inventory)

c. Total TV

12a. Check the type of District the facility is located in:

Plant Rehabilitation District

Industrial Development District

12b. Date district was established by local government unit (contact local unit)

12c. Is this application for a speculative building (Sec. 3(8))?

Yes

No

1

1 2

2 3

3 4

4