Reset

Print Form

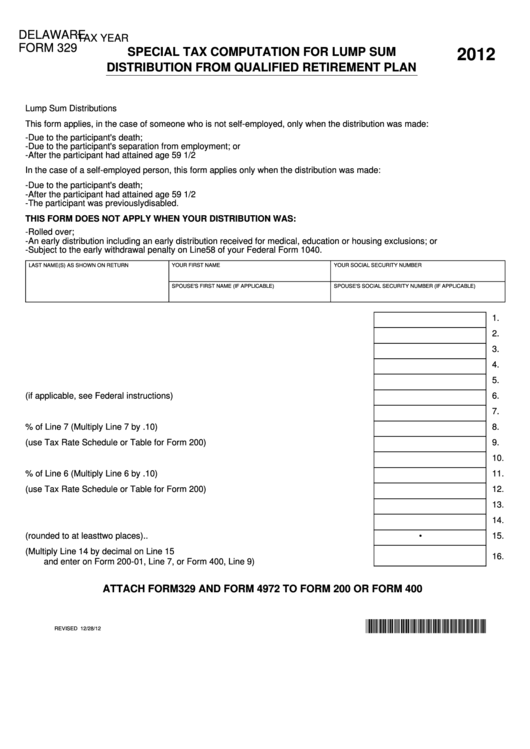

DELAWARE

TAX YEAR

FORM 329

SPECIAL TAX COMPUTATION FOR LUMP SUM

2012

DISTRIBUTION FROM QUALIFIED RETIREMENT PLAN

Lump Sum Distributions

This form applies, in the case of someone who is not self-employed, only when the distribution was made:

-Due to the participant's death;

-Due to the participant's separation from employment; or

-After the participant had attained age 59 1/2

In the case of a self-employed person, this form applies only when the distribution was made:

-Due to the participant's death;

-After the participant had attained age 59 1/2

-The participant was previously disabled.

THIS FORM DOES NOT APPLY WHEN YOUR DISTRIBUTION WAS:

-Rolled over;

-An early distribution including an early distribution received for medical, education or housing exclusions; or

-Subject to the early withdrawal penalty on Line 58 of your Federal Form 1040.

LAST NAME(S) AS SHOWN ON RETURN

YOUR FIRST NAME

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S FIRST NAME (IF APPLICABLE)

SPOUSE'S SOCIAL SECURITY NUMBER (IF APPLICABLE)

1.

Enter capital gain portion of distribution from Box 3 of Form 1099R...............................

1.

2.

Enter ordinary income portion of distribution from Box 2a of Form 1099R......................

2.

3.

Add Lines 1 and 2............................................................................................................

3.

4.

Death benefit exclusion allowed on Federal Form 4972..................................................

4.

5.

Subtract Line 4 from Line 3..............................................................................................

5.

6.

Current actuarial value of annuity (if applicable, see Federal instructions).....................

6.

7.

Total taxable amount of distribution. Add Lines 5 and 6.................................................

7.

8.

Enter 10% of Line 7 (Multiply Line 7 by .10)....................................................................

8.

9.

Compute the tax on Line 8 (use Tax Rate Schedule or Table for Form 200)..................

9.

10. Multiply the amount on Line 9 by ten...............................................................................

10.

11. Enter 10% of Line 6 (Multiply Line 6 by .10)....................................................................

11.

12. Compute the tax on Line 11 (use Tax Rate Schedule or Table for Form 200)................

12.

13. Multiply the amount on Line 12 by ten.............................................................................

13.

14. Subtract Line 13 from Line 10..........................................................................................

14.

.

15. Divide Line 2 by Line 3 and enter result as a decimal (rounded to at least two places)..

15.

16. Tax on ordinary income portion of distribution (Multiply Line 14 by decimal on Line 15

16.

and enter on Form 200-01, Line 7, or Form 400, Line 9)................................................

ATTACH FORM 329 AND FORM 4972 TO FORM 200 OR FORM 400

*DF30312019999*

REVISED 12/28/12

1

1