Instructions

Print

Reset

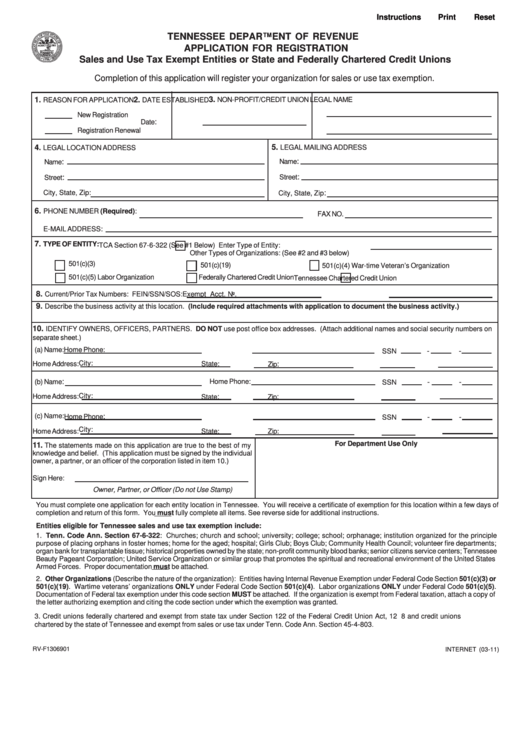

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR REGISTRATION

Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions

Completion of this application will register your organization for sales or use tax exemption.

3.

1.

2.

NON-PROFIT/CREDIT UNION LEGAL NAME

REASON FOR APPLICATION

DATE ESTABLISHED

New Registration

:

Date

Registration Renewal

4.

5.

LEGAL LOCATION ADDRESS

LEGAL MAILING ADDRESS

:

:

Name

Name

:

:

Street

Street

City, State, Zip:

:

City, State, Zip

6.

PHONE NUMBER (Required):

FAX NO.

E-MAIL ADDRESS:

7.

TYPE OF ENTITY:

TCA Section 67-6-322 (See #1 Below) Enter Type of Entity:

Other Types of Organizations: (See #2 and #3 below)

501(c)(3)

501(c)(19)

501(c)(4) War-time Veteran’s Organization

501(c)(5) Labor Organization

Federally Chartered Credit Union

Tennessee Chartered Credit Union

8.

Current/Prior Tax Numbers: FEIN/SSN/SOS:

Exempt Acct. No.

9.

Describe the business activity at this location. (Include required attachments with application to document the business activity.)

10.

IDENTIFY OWNERS, OFFICERS, PARTNERS. DO NOT use post office box addresses. (Attach additional names and social security numbers on

separate sheet.)

(a) Name:

Home Phone:

-

-

SSN

City:

State:

:

Home Address:

Zip

:

Home Phone:

(b) Name

-

-

SSN

City:

Home Address:

:

:

State

Zip

(c) Name:

:

Home Phone

-

-

SSN

City:

Home Address:

State:

Zip:

For Department Use Only

11.

The statements made on this application are true to the best of my

knowledge and belief. (This application must be signed by the individual

owner, a partner, or an officer of the corporation listed in item 10.)

Sign Here:

Owner, Partner, or Officer (Do not Use Stamp)

You must complete one application for each entity location in Tennessee. You will receive a certificate of exemption for this location within a few days of

completion and return of this form. You must fully complete all items. See reverse side for additional instructions.

Entities eligible for Tennessee sales and use tax exemption include:

1. Tenn. Code Ann. Section 67-6-322: Churches; church and school; university; college; school; orphanage; institution organized for the principle

purpose of placing orphans in foster homes; home for the aged; hospital; Girls Club; Boys Club; Community Health Council; volunteer fire departments;

organ bank for transplantable tissue; historical properties owned by the state; non-profit community blood banks; senior citizens service centers; Tennessee

Beauty Pageant Corporation; United Service Organization or similar group that promotes the spiritual and recreational environment of the United States

Armed Forces. Proper documentation must be attached.

2. Other Organizations (Describe the nature of the organization): Entities having Internal Revenue Exemption under Federal Code Section 501(c)(3) or

501(c)(19). Wartime veterans’ organizations ONLY under Federal Code Section 501(c)(4). Labor organizations ONLY under Federal Code 501(c)(5).

Documentation of Federal tax exemption under this code section MUST be attached. If the organization is exempt from Federal taxation, attach a copy of

the letter authorizing exemption and citing the code section under which the exemption was granted.

3. Credit unions federally chartered and exempt from state tax under Section 122 of the Federal Credit Union Act, 12 U.S.C. 1768 and credit unions

chartered by the state of Tennessee and exempt from sales or use tax under Tenn. Code Ann. Section 45-4-803.

RV-F1306901

INTERNET (03-11)

1

1 2

2