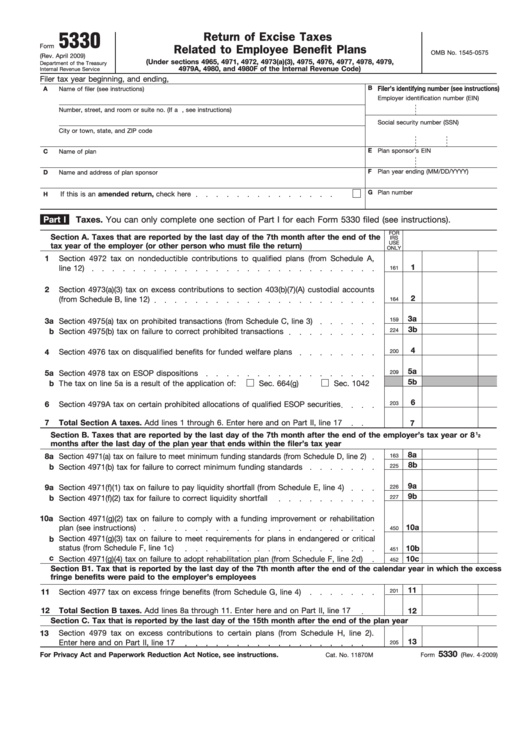

5330

Return of Excise Taxes

Form

Related to Employee Benefit Plans

OMB No. 1545-0575

(Rev. April 2009)

(Under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979,

Department of the Treasury

4979A, 4980, and 4980F of the Internal Revenue Code)

Internal Revenue Service

Filer tax year beginning

,

and ending

,

B

Filer’s identifying number (see instructions)

A

Name of filer (see instructions)

Employer identification number (EIN)

Number, street, and room or suite no. (If a P.O. box or foreign address, see instructions)

Social security number (SSN)

City or town, state, and ZIP code

E

Plan sponsor’s EIN

C

Name of plan

F

Plan year ending (MM/DD/YYYY)

D

Name and address of plan sponsor

G

Plan number

If this is an amended return, check here

H

Part I

Taxes. You can only complete one section of Part I for each Form 5330 filed (see instructions).

FOR

Section A. Taxes that are reported by the last day of the 7th month after the end of the

IRS

USE

tax year of the employer (or other person who must file the return)

ONLY

1

Section 4972 tax on nondeductible contributions to qualified plans (from Schedule A,

1

line 12)

161

2

Section 4973(a)(3) tax on excess contributions to section 403(b)(7)(A) custodial accounts

2

(from Schedule B, line 12)

164

3a

3a

Section 4975(a) tax on prohibited transactions (from Schedule C, line 3)

159

3b

224

b

Section 4975(b) tax on failure to correct prohibited transactions

4

4

Section 4976 tax on disqualified benefits for funded welfare plans

200

5a

5a

Section 4978 tax on ESOP dispositions

209

5b

b

The tax on line 5a is a result of the application of:

Sec. 664(g)

Sec. 1042

6

6

Section 4979A tax on certain prohibited allocations of qualified ESOP securities

203

7

Total Section A taxes. Add lines 1 through 6. Enter here and on Part II, line 17

7

Section B. Taxes that are reported by the last day of the 7th month after the end of the employer’s tax year or 8

1

⁄

2

months after the last day of the plan year that ends within the filer’s tax year

8a

8a Section 4971(a) tax on failure to meet minimum funding standards (from Schedule D, line 2)

163

8b

b

Section 4971(b) tax for failure to correct minimum funding standards

225

9a

9a

Section 4971(f)(1) tax on failure to pay liquidity shortfall (from Schedule E, line 4)

226

9b

b

Section 4971(f)(2) tax for failure to correct liquidity shortfall

227

10a

Section 4971(g)(2) tax on failure to comply with a funding improvement or rehabilitation

plan (see instructions)

10a

450

Section 4971(g)(3) tax on failure to meet requirements for plans in endangered or critical

b

status (from Schedule F, line 1c)

10b

451

c

Section 4971(g)(4) tax on failure to adopt rehabilitation plan (from Schedule F, line 2d)

10c

452

Section B1. Tax that is reported by the last day of the 7th month after the end of the calendar year in which the excess

fringe benefits were paid to the employer’s employees

11

11

Section 4977 tax on excess fringe benefits (from Schedule G, line 4)

201

12

Total Section B taxes. Add lines 8a through 11. Enter here and on Part II, line 17

12

Section C. Tax that is reported by the last day of the 15th month after the end of the plan year

13

Section 4979 tax on excess contributions to certain plans (from Schedule H, line 2).

13

Enter here and on Part II, line 17

205

5330

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11870M

Form

(Rev. 4-2009)

1

1 2

2 3

3 4

4 5

5 6

6