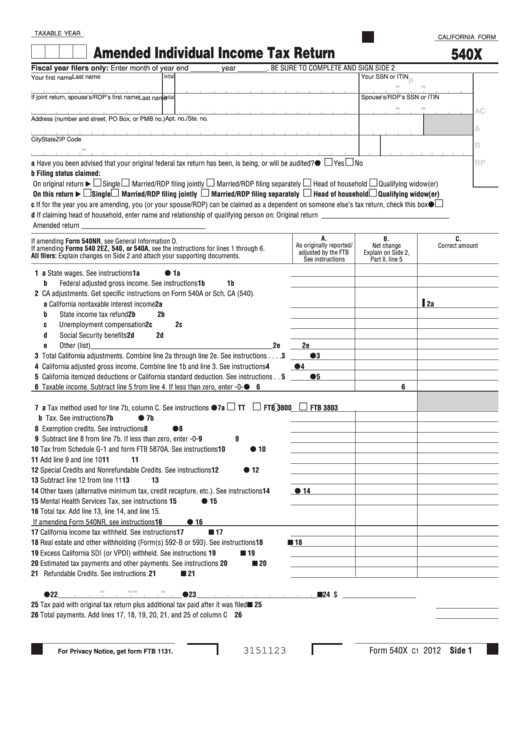

TAXABLE YEAR

CALIFORNIA FORM

Amended Individual Income Tax Return

540X

Fiscal year filers only: Enter month of year end _______ year _______.

BE SURE TO COMPLETE AND SIGN SIDE 2

Initial

Last name

Your SSN or ITIN

Your first name

-

-

P

Initial

If joint return, spouse’s/RDP’s first name

Spouse’s/RDP’s SSN or ITIN

Last name

-

-

AC

Apt. no./Ste. no.

Address (number and street, PO Box, or PMB no.)

A

City

State ZIP Code

-

R

m

m

RP

a

Have you been advised that your original federal tax return has been, is being, or will be audited? . . . . . . . . . . . . . . . .

Yes

No

b

Filing status claimed:

m

m

m

m

m

On original return

Single

Married/RDP filing jointly

Married/RDP filing separately

Head of household

Qualifying widow(er)

m

m

m

m

m

On this return

Single

Married/RDP filing jointly

Married/RDP filing separately

Head of household

Qualifying widow(er)

m

c

If for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, check this box . . . . . . . . . .

d

If claiming head of household, enter name and relationship of qualifying person on:

Original return ___________________________________

Amended return __________________________________

A.

B.

C.

If amending Form 540NR, see General Information D .

As originally reported/

Net change

Correct amount

If amending Forms 540 2EZ, 540, or 540A, see the instructions for lines 1 through 6 .

adjusted by the FTB

Explain on Side 2,

All filers: Explain changes on Side 2 and attach your supporting documents .

See instructions

Part ll, line 5

1 a State wages . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

1a

b Federal adjusted gross income . See instructions . . . . . . . . . . . . . . . . . . . . . . . . 1b

1b

2 CA adjustments . Get specific instructions on Form 540A or Sch . CA (540) .

▌ 2a

a California nontaxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b State income tax refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

2b

c Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

2c

d Social Security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

2d

e Other (list)__________________________________________________ . . . . 2e

2e

3 Total California adjustments . Combine line 2a through line 2e . See instructions . . . . 3

3

4 California adjusted gross income . Combine line 1b and line 3 . See instructions . . . . 4

4

5 California itemized deductions or California standard deduction . See instructions . . 5

5

6 Taxable income . Subtract line 5 from line 4 . If less than zero, enter -0- . . . . . . .

6

6

m

m

m

7 a Tax method used for line 7b, column C . See instructions . . . . . . . . . . . . . . .

7a

TT

FTB 3800

FTB 3803

b Tax . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

7b

8 Exemption credits . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

8

9 Subtract line 8 from line 7b . If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . 9

9

10 Tax from Schedule G-1 and form FTB 5870A . See instructions . . . . . . . . . . . . . . . . 10

10

11 Add line 9 and line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

11

12 Special Credits and Nonrefundable Credits . See instructions . . . . . . . . . . . . . . . . . . 12

12

13 Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13

14 Other taxes (alternative minimum tax, credit recapture, etc .) . See instructions . . . . 14

14

15 Mental Health Services Tax, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

15

16 Total tax . Add line 13, line 14, and line 15 .

If amending Form 540NR, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

16

17 California income tax withheld . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

17

18 Real estate and other withholding (Form(s) 592-B or 593) . See instructions . . . . . 18

18

19 Excess California SDI (or VPDI) withheld . See instructions . . . . . . . . . . . . . . . . . . . 19

19

20 Estimated tax payments and other payments . See instructions . . . . . . . . . . . . . . . . 20

20

21 Refundable Credits . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

21

-

-

-

-

22 __________________________________

23 _________________________________

24 $ ____________________

25 Tax paid with original tax return plus additional tax paid after it was filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Total payments . Add lines 17, 18, 19, 20, 21, and 25 of column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

Form 540X

2012 Side 1

3151123

C1

For Privacy Notice, get form FTB 1131.

1

1 2

2