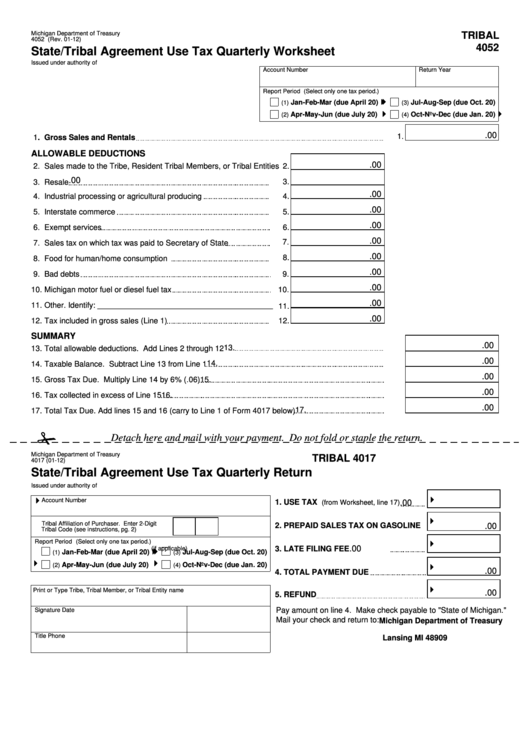

Michigan Department of Treasury

TRIBAL

4052 (Rev. 01-12)

4052

State/Tribal Agreement Use Tax Quarterly Worksheet

Issued under authority of P.A. 616 of 2002. Filing is voluntary.

Account Number

Return Year

Report Period

(Select only one tax period.)

Jan-Feb-Mar (due April 20)

Jul-Aug-Sep (due Oct. 20)

(1)

(3)

Apr-May-Jun (due July 20)

Oct-Nov-Dec (due Jan. 20)

(2)

(4)

.00

1.

1. Gross Sales and Rentals

ALLOWABLE DEDUCTIONS

.00

2. Sales made to the Tribe, Resident Tribal Members, or Tribal Entities

2.

.00

3.

3. Resale

.00

4. Industrial processing or agricultural producing

4.

.00

5. Interstate commerce

5.

.00

6. Exempt services

6.

.00

7.

7. Sales tax on which tax was paid to Secretary of State

.00

8.

8. Food for human/home consumption

.00

9. Bad debts

9.

.00

10. Michigan motor fuel or diesel fuel tax

10.

.00

11. Other. Identify: ________________________________________

11.

.00

12. Tax included in gross sales (Line 1)

12.

SUMMARY

.00

13.

13. Total allowable deductions. Add Lines 2 through 12

.00

14.

14. Taxable Balance. Subtract Line 13 from Line 1

.00

15. Gross Tax Due. Multiply Line 14 by 6% (.06)

15.

.00

16. Tax collected in excess of Line 15

16.

.00

17.

17. Total Tax Due. Add lines 15 and 16 (carry to Line 1 of Form 4017 below)

Detach here and mail with your payment. Do not fold or staple the return.

Michigan Department of Treasury

TRIBAL 4017

4017 (01-12)

State/Tribal Agreement Use Tax Quarterly Return

Issued under authority of P.A. 616 of 2002.

Account Number

1. USE TAX

(from Worksheet, line 17)

.00

Tribal Affiliation of Purchaser. Enter 2-Digit

2. PREPAID SALES TAX ON GASOLINE

.00

Tribal Code (see instructions, pg. 2)

Report Period

(Select only one tax period.)

.00

3. LATE FILING FEE

(if applicable)

Jan-Feb-Mar (due April 20)

Jul-Aug-Sep (due Oct. 20)

(1)

(3)

Apr-May-Jun (due July 20)

Oct-Nov-Dec (due Jan. 20)

(2)

(4)

.00

4. TOTAL PAYMENT DUE

Print or Type Tribe, Tribal Member, or Tribal Entity name

.00

5. REFUND

Pay amount on line 4. Make check payable to "State of Michigan."

Signature

Date

Mail your check and return to: Michigan Department of Treasury

P.O. Box 30781

Title

Phone

Lansing MI 48909

1

1 2

2