Instructions For Form 345 - Arizona Credit For New Employment - 2014

ADVERTISEMENT

Arizona Form

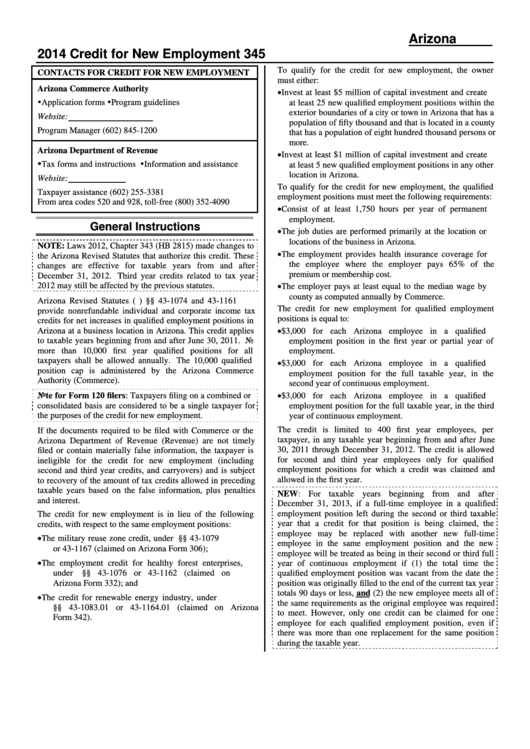

2014 Credit for New Employment

345

To qualify for the credit for new employment, the owner

CONTACTS FOR CREDIT FOR NEW EMPLOYMENT

must either:

Arizona Commerce Authority

Invest at least $5 million of capital investment and create

Application forms Program guidelines

at least 25 new qualified employment positions within the

exterior boundaries of a city or town in Arizona that has a

Website:

population of fifty thousand and that is located in a county

Program Manager

(602) 845-1200

that has a population of eight hundred thousand persons or

more.

Arizona Department of Revenue

Invest at least $1 million of capital investment and create

Tax forms and instructions Information and assistance

at least 5 new qualified employment positions in any other

location in Arizona.

Website:

To qualify for the credit for new employment, the qualified

Taxpayer assistance

(602) 255-3381

employment positions must meet the following requirements:

From area codes 520 and 928, toll-free

(800) 352-4090

Consist of at least 1,750 hours per year of permanent

employment.

General Instructions

The job duties are performed primarily at the location or

locations of the business in Arizona.

NOTE: Laws 2012, Chapter 343 (HB 2815) made changes to

The employment provides health insurance coverage for

the Arizona Revised Statutes that authorize this credit. These

the employee where the employer pays 65% of the

changes are effective for taxable years from and after

premium or membership cost.

December 31, 2012. Third year credits related to tax year

The employer pays at least equal to the median wage by

2012 may still be affected by the previous statutes.

county as computed annually by Commerce.

Arizona Revised Statutes (A.R.S.) §§ 43-1074 and 43-1161

The credit for new employment for qualified employment

provide nonrefundable individual and corporate income tax

positions is equal to:

credits for net increases in qualified employment positions in

$3,000 for each Arizona employee in a qualified

Arizona at a business location in Arizona. This credit applies

to taxable years beginning from and after June 30, 2011. No

employment position in the first year or partial year of

more than 10,000 first year qualified positions for all

employment.

taxpayers shall be allowed annually. The 10,000 qualified

$3,000 for each Arizona employee in a qualified

position cap is administered by the Arizona Commerce

employment position for the full taxable year, in the

Authority (Commerce).

second year of continuous employment.

$3,000 for each Arizona employee in a qualified

Note for Form 120 filers: Taxpayers filing on a combined or

consolidated basis are considered to be a single taxpayer for

employment position for the full taxable year, in the third

the purposes of the credit for new employment.

year of continuous employment.

The credit is limited to 400 first year employees, per

If the documents required to be filed with Commerce or the

taxpayer, in any taxable year beginning from and after June

Arizona Department of Revenue (Revenue) are not timely

30, 2011 through December 31, 2012. The credit is allowed

filed or contain materially false information, the taxpayer is

for second and third year employees only for qualified

ineligible for the credit for new employment (including

employment positions for which a credit was claimed and

second and third year credits, and carryovers) and is subject

allowed in the first year.

to recovery of the amount of tax credits allowed in preceding

taxable years based on the false information, plus penalties

NEW: For taxable years beginning from and after

and interest.

December 31, 2013, if a full-time employee in a qualified

employment position left during the second or third taxable

The credit for new employment is in lieu of the following

year that a credit for that position is being claimed, the

credits, with respect to the same employment positions:

employee may be replaced with another new full-time

The military reuse zone credit, under A.R.S. §§ 43-1079

employee in the same employment position and the new

or 43-1167 (claimed on Arizona Form 306);

employee will be treated as being in their second or third full

The employment credit for healthy forest enterprises,

year of continuous employment if (1) the total time the

under A.R.S. §§ 43-1076 or 43-1162 (claimed on

qualified employment position was vacant from the date the

Arizona Form 332); and

position was originally filled to the end of the current tax year

totals 90 days or less, and (2) the new employee meets all of

The credit for renewable energy industry, under A.R.S.

the same requirements as the original employee was required

§§ 43-1083.01 or 43-1164.01 (claimed on Arizona

to meet. However, only one credit can be claimed for one

Form 342).

employee for each qualified employment position, even if

there was more than one replacement for the same position

during the taxable year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5